📈 Stablecoin transactions reached US$94 billion from Jan 2023 to Feb 2025; Canary Capital submits S-1 for first spot CRO ETF in the US

Stablecoin transactions reached US$94B from Jan 2023 to Feb 2025; Canary Capital submits S-1 for first US spot CRO ETF; Crypto.com signs MOU to integrate Crypto.com Pay into NEXPACE’s gaming ecosystem

Quick Take

Stablecoin transactions reached US$94 billion between Jan 2023 and Feb 2025; Canary Capital submits S-1 for the first spot CRO ETF in the US; Crypto.com signs a Memorandum of Understanding (MOU) to integrate Crypto.com Pay into NEXPACE’s gaming ecosystem

US spot bitcoin ETFs had a net inflow of $67 million in the past five trading days compared to $2.75 billion the week before. BlackRock’s IBIT ETF, on the other hand, experienced its highest daily net outflow of $431 million on 30 May. Spot ether ETFs also saw a net inflow of $344 million in the past five trading days.

On the macro side, the US FOMC Minutes revealed uncertainties around the economic outlook and tariffs that may worsen inflation. The US core Personal Consumption Expenditures (PCE) Price Index increased 2.5% year-on-year, which is lower than the estimated 2.6%. The latest CME FedWatch Tool showed a 5% probability of a June rate cut in the US compared to 6% last week. New Zealand’s RBNZ cut interest rates by 0.25% to 3.25%, in line with expectations.

Notable updates: The Crypto.com App listed Vaulta (A), Sophon (SOPH), and Space and Time (SXT).

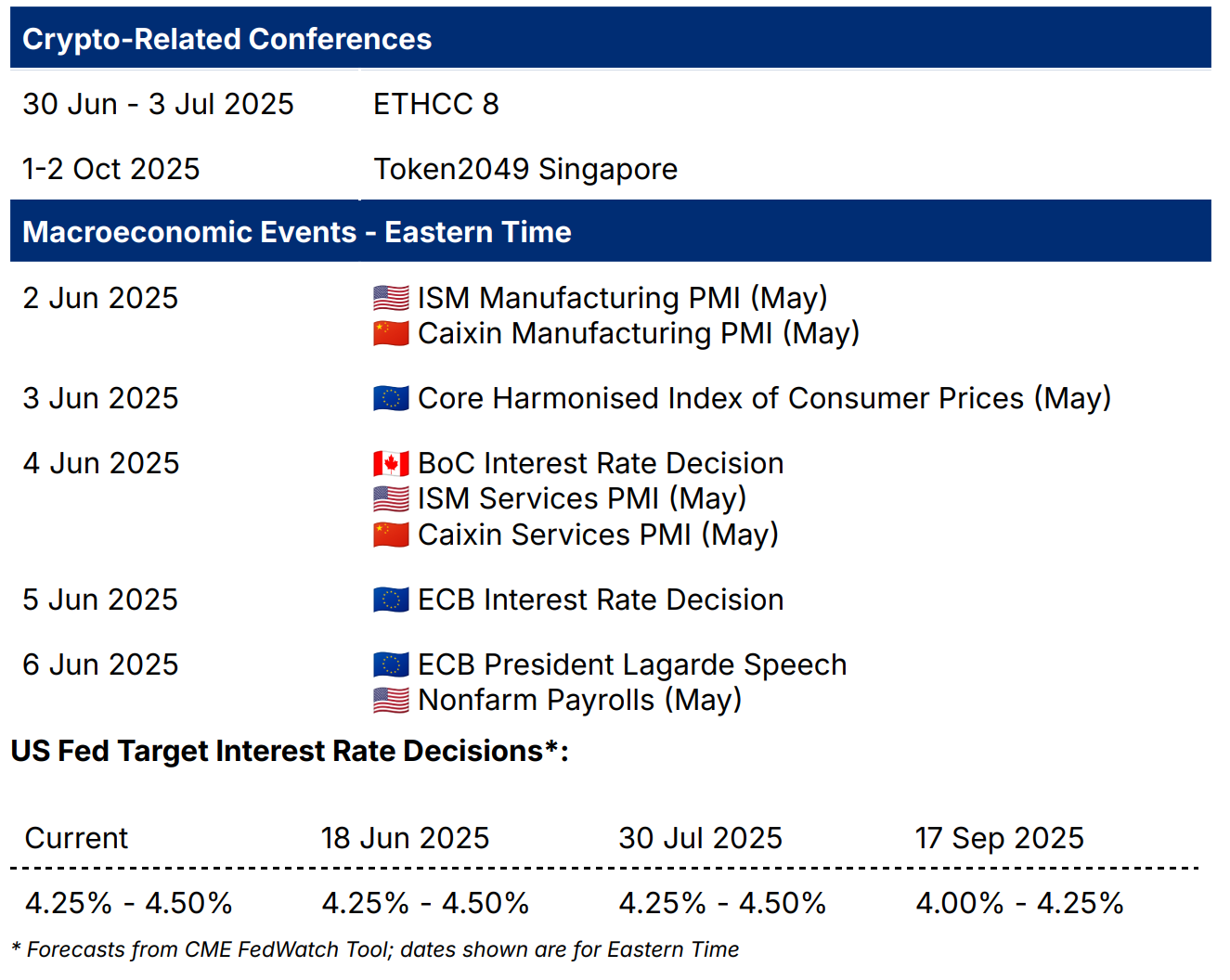

Notable events in the coming week: ECB Interest Rate Decision, US ISM Manufacturing and Services PMI, US Nonfarm Payrolls

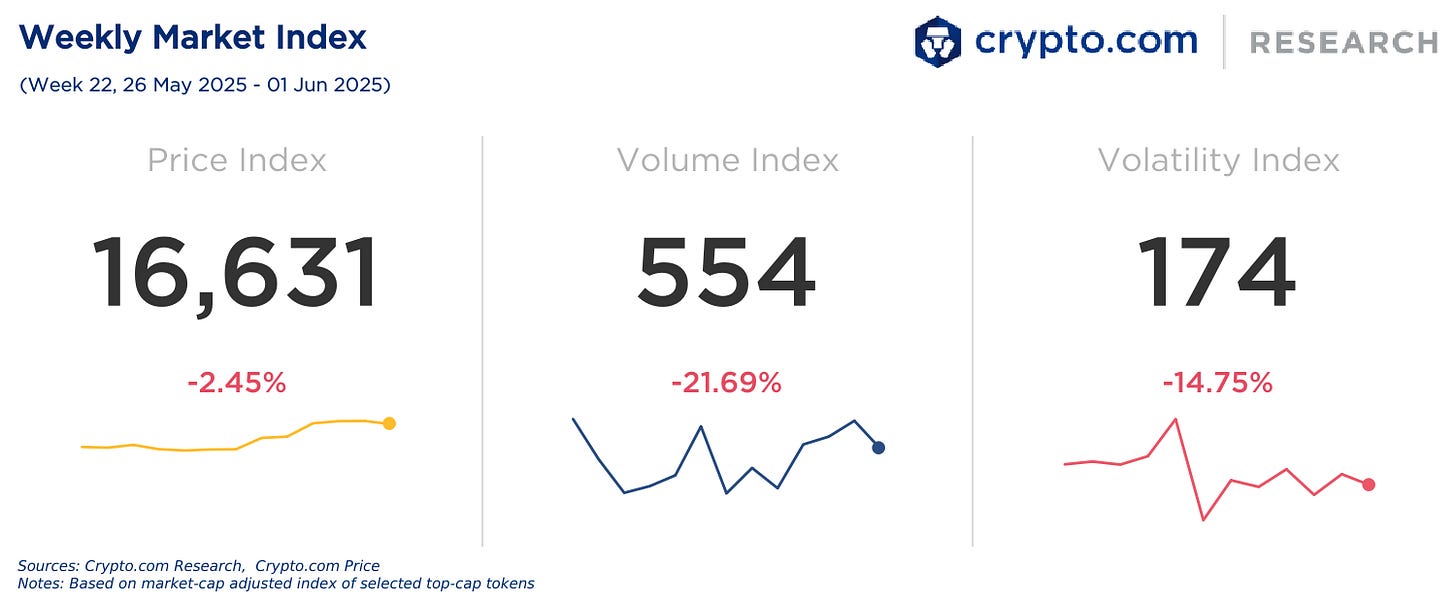

Weekly Market Index

Price, volume, and volatility indices were down by -2.45%, -21.69%, and -14.75% respectively.

Price decrease coincided with the US FOMC minutes highlighting inflation risks and economic uncertainties. The first rate cut is expected to occur in September according to the latest CME FedWatch Tool.

All tokens decreased in trading volume except CRO (+73.64%) and FIL (+3.59%), which coincided with Canary Capital filing for the first spot CRO ETF in the US.

Chart of the Week

Stablecoin transactions amounted to $94 billion between January 2023 and February 2025, according to data from Artemis. Business-to-business (B2B) payments dominated transactions since July 2024, growing from 39% in July 2024 to 49% in February 2025. Card-linked stablecoin payments grew by 103%, ballooning from $543 million in February 2024 to $1.1 billion in February 2025. This reflected the status of stablecoins as an essential part of the global payments infrastructure.

Weekly Performance

CRO (+9.6%) took the lead in price increase last week, coinciding with Canary Capital’s S-1 submission for the first spot CRO ETF in the US. BTC and ETH decreased by -3.4% and -0.9%, respectively, while other large-cap tokens saw a price downtrend.

All key categories decreased in market capitalisation in the past seven days, with the Layer-1 category seeing the least losses.

Newly Listed Tokens in Crypto.com App

News Highlights

Crypto.com / Cronos News

Canary Capital, a digital asset-focused investment firm, submitted an S-1 to the US Securities and Exchange Commission (SEC) for the first spot CRO ETF in the US. Crypto.com will serve as a custodian and liquidity provider of the fund.

Crypto.com signed an MoU with NEXPACE, the Web3 and blockchain subsidiary of the global gaming company NEXON. The agreement aims to integrate Crypto.com Pay into NEXPACE’s gaming ecosystem, which will allow players to pay using cryptocurrencies across NEXPACE’s games and digital marketplaces.

Adoption

The Reserve Bank of India (RBI) is expected to increase the number of use cases for its retail and wholesale central bank digital currencies (CBDCs). This includes exploring the programmability and offline capabilities of the digital rupee, especially in remote areas with limited internet.

Kazakhstan plans to launch Cryptocity, a pilot zone where crypto can be used to pay for goods and services in a regulated sandbox environment. The government and regulators are working together to finalise a suitable location for the pilot.

The head of Pakistan’s crypto council announced that the country is establishing a strategic bitcoin reserve, embracing pro-crypto regulatory policies. This comes after the country planned to use excess energy to support bitcoin mining and computing data centers in May 2025.

Thailand plans to allow tourists to link their crypto holdings to credit cards for local purchases. The country is also planning to reform its financial laws, including those related to broader capital markets.

The Dubai Land Department launched its first licensed tokenised real estate project that can tokenise up to $16 billion worth of real estate. The title deeds will be tokenised on XRP Ledger, allowing investors to purchase a fraction of Dubai properties at a starting price of 2,000 dirhams ($540).

BNP Paribas Asset Management, the asset management arm of one of France’s largest banks, launched natively tokenised money market fund shares. The firm aims to test cross-border transactions using distributed ledger technology.

Premier football club Paris Saint-Germain F.C. (PSG) reportedly started buying bitcoin last year, and is holding the digital asset as part of their reserves. It is currently the first sports team known to be a bitcoin holder.

Trump Media and Technology Group, a company partially owned by US president Donald Trump, raised $2.5 billion to purchase BTC. This comes as more companies stockpile bitcoin in their treasuries.

Investment Vehicles

Nasdaq filed to list a spot Sui ETF for 21Shares with the US Securities and Exchange Commission (SEC), kicking off the review process with the SEC.

USDC issuer Circle launched an initial public offering (IPO) of 24 million shares of its class A common stock, and applied for listing on the New York Stock Exchange with the ticker ‘CRCL’. The company expects to potentially raise $576 to $624 million, with BlackRock considering buying approximately 10% of the total shares offered in the IPO.

Regulation

The US SEC issued new guidance on crypto staking, one of which states that staking activities on proof of stake networks under certain circumstances are not securities transactions. This also applies to third-party staking, or when custodians stake on behalf of asset owners.

The US Labour Department rescinded a 2022 guidance that directed fiduciaries to exercise “extreme care” before including crypto in 401(k) retirement plans. This may give asset managers more flexibility to include digital assets in retirement investments.

Recent Research Report

Research Roundup Newsletter [April 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into ‘The Rise of Crypto Treasury’ and ‘Wall Street On-Chain Part 3: Trading & Liquidity’.

Wall Street On-Chain Part 3: Trading & Liquidity: This report compares liquidity between popular TradFi assets and major crypto assets, and delves into the development of crypto exchanges.

Alpha Navigator: Quest for Alpha [April 2025]: All asset classes had mixed performances in April, with BTC and Gold leading price increases. Trump reduced tariff rates on imports from most US trading partners and considered lowering tariffs on China.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Cro all the way , Crypto.com No1