₿ Utah could be the first US state to potentially establish a bitcoin reserve; Crypto.com received its MiCA licence and launched Crypto.com Custody services internationally

Utah could be the first US state to establish a bitcoin reserve; Crypto.com received its Markets in Crypto Assets (MiCA) licence and announced the international launch of Crypto.com Custody services

Quick Take

Utah could be the first US state to potentially establish a bitcoin reserve; Crypto.com received its Markets in Crypto Assets (MiCA) licence and announced the international launch of Crypto.com Custody services

US spot bitcoin ETFs had a net inflow of US$560 million last week, plunging by 80% week-on-week. Spot ether ETFs saw a net outflow of $45 million last week (vs net inflows of $163 million the week before).

On the macro side, the US Fed left interest rates unchanged at 4.25% to 4.50%, in line with market expectations, while citing that inflation “remains somewhat elevated” and the labour market remains solid. European Central Bank (ECB) cut interest rates by 0.25% to 2.75%, while ECB President Christine Lagarde mentioned that the Euro area economy “is set to remain weak in the near term”. Bank of Canada cut interest rates by 0.25% to 3%. The latest CME FedWatch Tool showed a 85% probability of a March rate cut in the US.

Notable updates: Uniswap (UNI) announced that v4 is available across 12 chains, Jupiter Exchange (JUP) introduced JupNet

Notable events in the coming week: Bank of England’s interest rate decision, US nonfarm payrolls

Weekly Market Index

Price and volume indices decreased last week by -6.85% and -28.93%, respectively. The volatility index was up by +225.77%, and was led by STX (+289.42%) and DOT (+271.69%). 21Shares filed with the US SEC to launch a spot Polkadot ETF, 21Shares Polkadot Trust, on the Cboe BZX exchange.

Chinese AI company Deepseek advanced as a low-cost competitor to international AI leaders, which coincided with global investors dumping technology stocks early last week while cryptocurrencies in the index also saw a drop in price. The price drop also coincided with US President Donald Trump signing an order imposing tariffs on imports from Mexico, Canada, and China.

Chart of the Week

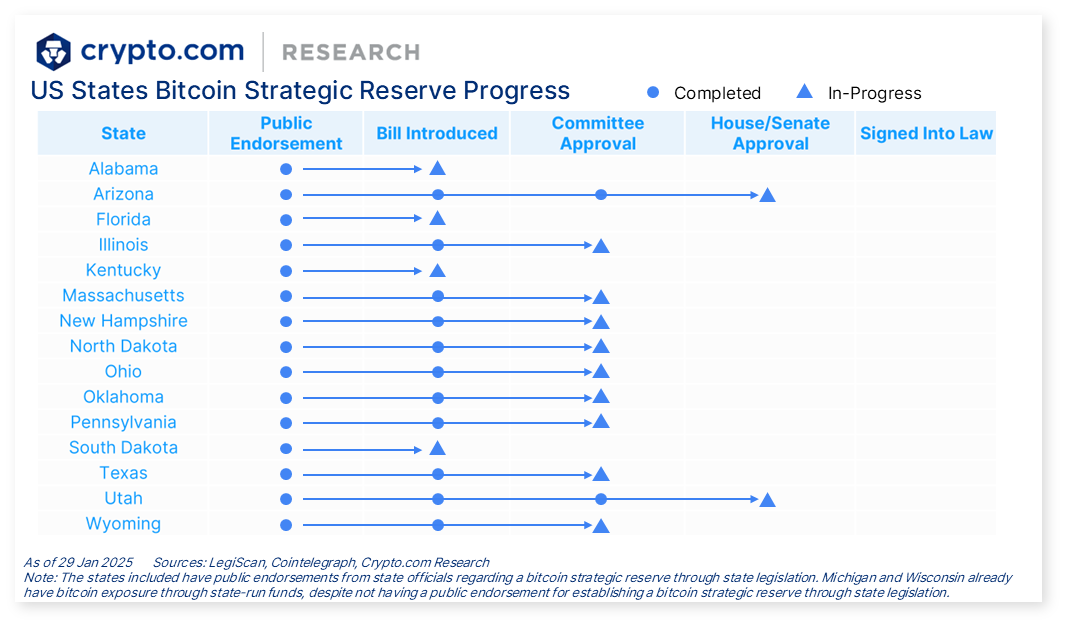

Utah is leading the effort to establish a bitcoin reserve, with a bill currently in the state legislature. If passed, the bill would allow the state to be the first state in the US to invest a portion of public funds into BTC and other cryptocurrencies.

According to Satoshi Action Fund CEO Dennis Porter, Utah’s shorter legislative window (with a decision to be made in 45 days) and other positive factors led the state to lead in progress in potentially passing the bill. Arizona has made similar progress, while nine other states have introduced bills to establish a bitcoin reserve.

Weekly Performance

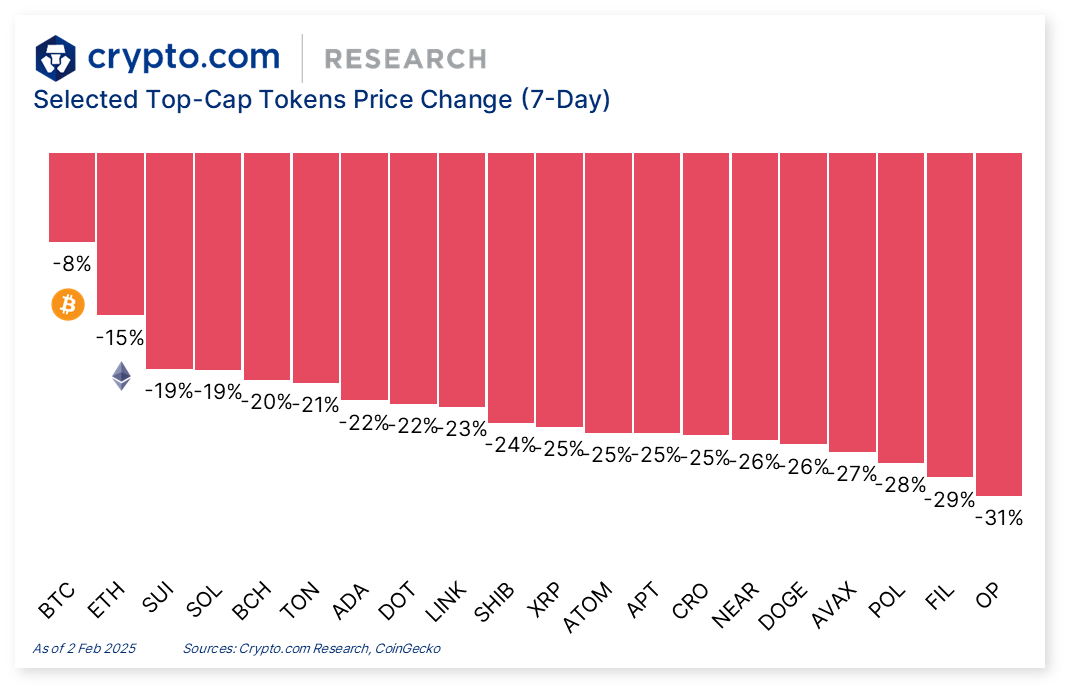

BTC and ETH decreased by -7.9% and -14.5%, respectively, in the past seven days. Prices of all other selected top market capitalisation tokens were down.

All key categories decreased in market capitalisation in the past seven days. AI category led the decrease.

Notable Token Updates

News Highlights

Crypto.com News

Crypto.com announced that its Malta entity has received a MiCA licence from the Malta Financial Services Authority (MFSA). The company is the first major global crypto asset service provider (CASP) to receive a full MiCA licence, which will allow Crypto.com to provide services across the European Economic Area (EEA).

Crypto.com announced the international launch of Crypto.com Custody, the group’s institutional-grade custody offering. The custodian is tailored for institutional users.

Investment Vehicles

The US Securities and Exchange Commission (SEC) acknowledged Canary Capital’s spot Litecoin ETF 19b-4 application. This is the first altcoin 19b-4 filing to be acknowledged, according to Bloomberg analyst Eric Balchunas. The current review process includes public comments and further review, and the SEC has up to 240 days to approve or reject it.

US futures exchange Chicago Mercantile Exchange (CME) Group will list options tied to its Bitcoin Friday futures on 24 February, pending regulatory approval. The options will settle in cash rather than spot bitcoin, and aim to provide investors with tools to manage short-term bitcoin price risk.

Grayscale launched Grayscale Dogecoin Trust, an investment fund for Dogecoin, available to institutional investors. The firm also filed with the SEC to convert its XRP Trust into an ETF on the New York Stock Exchange (NYSE).

The US SEC initially approved Bitwise Asset Manager’s Bitcoin and Ethereum ETF. The ETF gives exposure to the spot price of bitcoin and ether, weighted according to the asset’s relative market capitalisation. Bitwise still needs the SEC approval of its form S-1. In addition, Bitwise filed an S-1 with the SEC for a Dogecoin ETF.

21Shares filed with the US SEC to launch a spot Polkadot ETF, 21Shares Polkadot Trust, on the Cboe BZX exchange. In February 2021, the asset manager launched a Polkadot ETF on the Swiss SIX exchange.

Cboe BZX Exchange resubmitted filings on behalf of four asset managers (Bitwise, VanEck, 21 Shares, and Canary Capital) that are looking to list Solana ETFs in the US, aiming to kickstart the SEC’s review process again.

ETF provider Tuttle Capital filed for ten crypto-based leveraged ETFs, including 2x leveraged ETFs on XRP, SOL, LTC, ADA, LINK, and DOT as well as meme coins TRUMP, MELANIA, and BONK.

Investment firm Apollo Global Management partnered with Securitize to launch a tokenised private credit fund. The Apollo Diversified Credit Securitize Fund (ACRED) will tokenise shares of its Apollo Diversified Credit Fund, which holds a portfolio of private credit assets, and will be on blockchains including Solana, Ethereum, Avalanche, Polkadot, Aptos, and Ink.

Adoption

The Trump Media and Technology Group (TMTG), partially owned by US President Donald Trump, announced its expansion into financial services and crypto under the name Truth.Fi. It also authorised an investment of up to $250 million through Charles Schwab to diversify its cash holdings.

Swiss bank UBS is testing blockchain technology for digital gold investments. It has completed a proof-of-concept for its fractional gold investment product, UBS Key4 Gold on ZKSync, aiming to leverage its scalability, privacy, and interoperability.

The Czech National Bank (CNB) approved a proposal to study the potential inclusion of bitcoin as a reserve asset. This proposal was put forward by CNB Governor Aleš Michl, who aims to diversify the bank's portfolio. However, the idea has faced criticism from Czech Finance Minister and European Central Bank (ECB) President Christine Lagarde, who expressed confidence that bitcoin will not become part of any EU central bank's reserves. The CNB has stated that no changes will be implemented until the analysis is complete.

Recent Research Report

Crypto Market Sizing Report 2024: Global crypto owners reached 659 million by the end of 2024.

AI Agent Landscape: The AI agents sector has recently taken off, with top tokens showing an exponential increase in market cap in the past few months. This report looks into the AI agent landscape and delves into some major players and emerging use cases.

Performance Review for 2024 Highlighted Projects: In this report, we analyse the price performance of key trends in the cryptocurrency landscape that we covered throughout 2024. Artificial intelligence (AI) emerged as the best-performing sector in 2024.

Recent University Articles

How Do Political Events Affect Crypto Markets?: Discover how political events, elections, and regulatory decisions impact crypto markets, from Bitcoin’s record post-election high to ETF approvals and interest rate decisions.

Bitcoin vs Monero: Comparing Two Well-Established PoW Protocols: Discover the differences between Bitcoin (BTC) and Monero (XMR), two Proof of Work (PoW) cryptocurrencies with unique goals.

What Is the TRUMP Meme Coin? How to Buy TRUMP: Discover how TRUMP, the official meme coin launched by US President Donald Trump, caught the crypto community by surprise leading into his inauguration.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Great information!