📉 BTC’s implied volatility fell to Oct 2023 lows; Crypto.com celebrated its 9th anniversary

BTC’s implied volatility fell to Oct 2023 lows; Crypto.com celebrated its 9th anniversary; US House Republicans announced ‘Crypto Week’ to consider 3 crypto bills

Quick Take

Bitcoin’s implied volatility fell to October 2023 lows; Crypto.com celebrated its 9th anniversary; Republicans in the US House of Representatives announced ‘Crypto Week’ to consider three crypto bills.

US spot BTC ETFs had a net inflow of $1.3 billion in the past five trading days, compared to $2.2 billion the week before, reaching nearly $50 billion in cumulative net inflow. Spot ETH ETFs saw a net inflow of $297 million in the same period, higher than $284 million the week before.

On the macro side, US nonfarm payrolls increased by 147,000 in June, higher than the 110,000 estimate. The unemployment rate fell to 4.1%, the lowest level since February. This was in contrast to US private sector jobs data, which was 33,000 lower in June and hit its lowest level since March 2023. US Fed Chair Powell mentioned that the Fed would have cut interest rates by now if not for US President Trump’s tariff plans. The latest CME FedWatch Tool showed a 5% probability of a rate cut in July, compared to 18% the week prior.

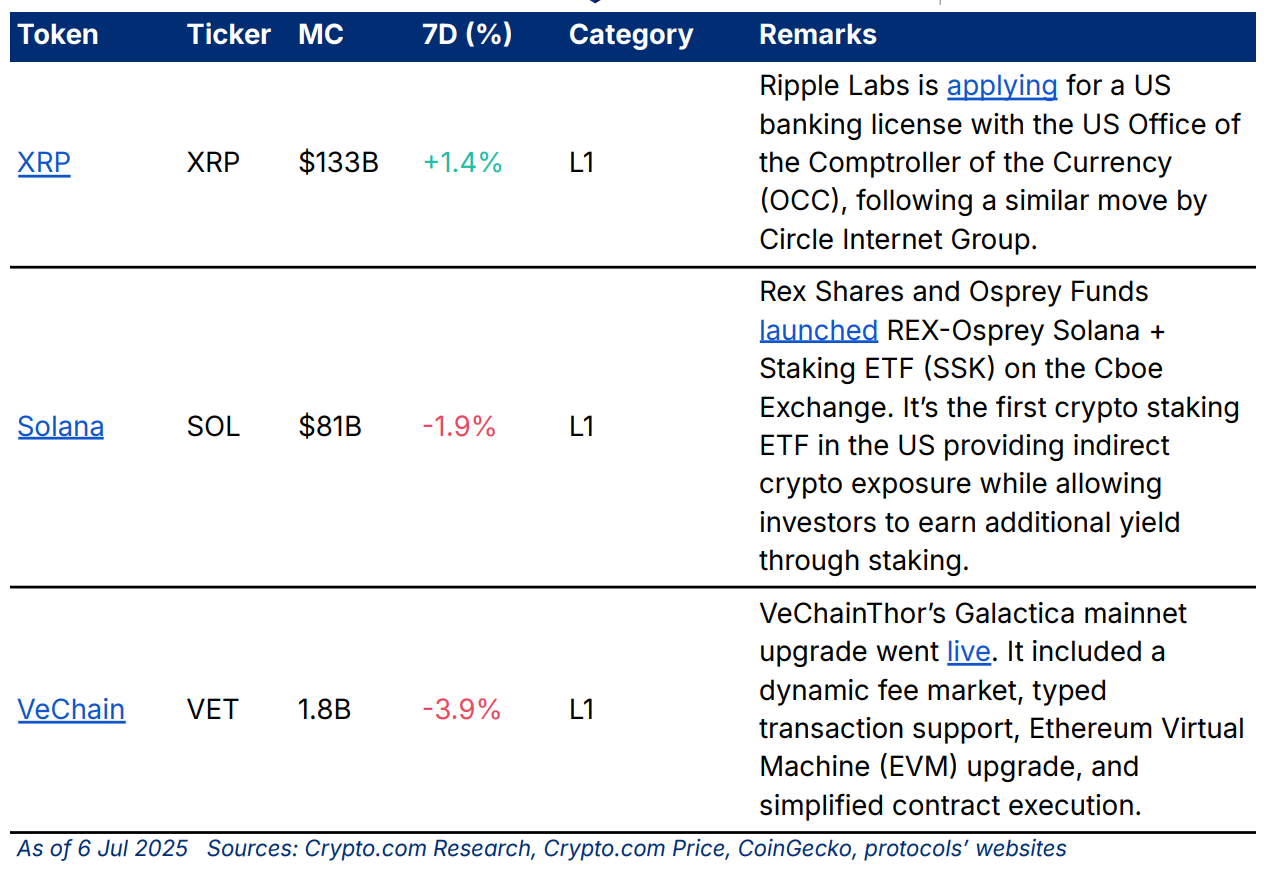

Notable updates: Ripple Labs is applying for a US banking license; Rex Shares and Osprey Funds launched REX-Osprey Solana + Staking ETF (SSK) on the Cboe Exchange.

Notable events in the coming week: Australia’s RBA and New Zealand’s RBNZ Interest Rate Decisions, US FOMC Minutes

Weekly Market Index

The price index was up by +1.71%, while the volume and volatility indices dipped by -5.98% and -14.78%, respectively.

Tokens in the weekly market index showed mixed price changes last week amid mixed US labour data and a lower probability of a July rate cut of 5% compared to 18% the week before.

Volatility drop was led by XRP (-73.55%) and ONDO (-62.50%). Ripple Labs is applying for a US banking license. Ondo Finance acquired Oasis Pro, an infrastructure provider of tokenised real-world assets, to strengthen its tokenised securities ecosystem in the US. SOL (+27.95%) was an exception with a volatility increase, which coincided with Rex Shares and Osprey Funds launching REX-Osprey Solana + Staking ETF (SSK) on the Cboe Exchange.

Chart of the Week

Bitcoin’s at-the-market (ATM) implied volatility, which tracks its expected price movements from one week to six months, fell to October 2023 lows. This potentially suggests expectations of a relatively stable market.

On the other hand, US spot BTC ETFs recorded $4.6 billion in monthly net inflows in June and close to $50 billion in cumulative net inflows since inception.

Weekly Performance

Top-cap tokens’ performances were mixed last week, led by SUI and DOGE. The prices of BTC and ETH increased by +1.9% and +3.3%, respectively.

Key categories showed mixed changes in market capitalisation in the last seven days. Meme and Layer-1 increased while Layer-2 led the drop.

Notable Updates

News Highlights

Crypto.com / Cronos News

Crypto.com celebrated its 9th year anniversary with a nine-day giveaway campaign for sporting event tickets, signed merchandise, CRO rewards, and more.

Adoption

JPMorgan’s blockchain arm Kinexys is working with S&P Global to explore the tokenisation of carbon credits. The focus will be creation and tracking processes, and how blockchain can be used to enhance transparency.

Deutsche Bank is aiming to launch its crypto custody service in 2026, as institutional demand for crypto services continues to grow.

JD.com and Ant Group are reportedly pushing for Chinese regulators to allow RMB-based stablecoins to launch in Hong Kong. This aims to strengthen the currency’s role in global trades and counter the rise in USD-pegged stablecoins.

Belgium’s KBC Bank, the country’s second-largest banking institution, is planning to enable retail clients to trade bitcoin and ether on its Bolero investment platform. It is pending regulatory approval expected in autumn 2025.

The National Bank of Kazakhstan said it is developing a sovereign reserve to hold bitcoin and other crypto. Potential funding sources include seized crypto assets and crypto mining operations that the state holds an interest in.

Investment Vehicles

Rex Shares and Osprey Funds launched REX-Osprey Solana + Staking ETF (SSK) on the Cboe Exchange. It is the first crypto staking ETF in the US providing indirect crypto exposure while allowing investors to earn additional yield through staking.

Centrifuge and S&P Dow Jones Indices (S&P DJI) announced plans to launch the first tokenised S&P 500 Index fund. The partnership will also feature a new Proof-of-Index infrastructure, which allows S&P DJI-licensed asset managers to launch index-tracking funds using S&P 500 data.

The US Securities and Exchange Commission (SEC) put a pause on the conversion of Grayscale's Digital Large Cap Fund (GDLC) to a spot crypto ETF one day after granting approval. The fund primarily tracks the price of bitcoin (80%) and ether (11%), with Solana, Cardano, and XRP represented in single-digit percentages.

Regulation

Republican leaders of the US House of Representatives are expected to consider three crypto-related bills in the upcoming ‘Crypto Week’ from 14 to 18 July. The bills include the Digital Asset Market Clarity Act, the Anti Central Bank Digital Currency (CBDC) Surveillance State Act, and the GENIUS Act focused on stablecoins.

The US SEC is reportedly considering establishing a generic listing framework to allow crypto ETFs that meet the pre-defined criteria to skip the 19b-4 filing process. Issuers can file a S-1, go through the 75-day review period, and launch the fund if it meets the listing standard.

Recent Research Report

Crypto Credit Market: This report offers an overview of the crypto credit market, and emphasises the design of a decentralised lending ecosystem. It will also examine how traditional financial players are piloting blockchain-based credit frameworks, including experiments with on-chain private credit.

InfoFi: This report introduces the notable players in the Yap-to-Earn, Attention Market, and Reputation Market categories of InfoFi, as well as discusses the significance and challenges of InfoFi’s development.

Interest Rate Derivatives and Pendle: Pendle Finance innovates by allowing users to tokenise and trade the yield component of yield-bearing assets separately from the principal, unlocking new liquidity and yield management strategies.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!