🚀 Ethereum surged 21% on 8 May after the Pectra upgrade, its biggest daily gain since May 2021; 21Shares launched a CRO ETP in Europe

ETH surged 21% on 8 May after the Pectra upgrade, its biggest daily gain since May 2021; 21Shares launched a CRO ETP in Europe; New Hampshire and Arizona enacted crypto reserve bills

Quick Take

Ethereum surged 21% on 8 May after the Pectra upgrade, marking its biggest daily gain since May 2021; 21Shares launched a CRO ETP in Europe; New Hampshire and Arizona enacted crypto reserve bills

US spot bitcoin ETFs had a net inflow of US$921 million in last week, the fourth consecutive week of net inflows. BlackRock’s IBIT saw 19 consecutive days of net inflows, the longest streak in 2025. Spot ether ETFs saw a net outflow of $38 million last week.

On the macro side, the US Federal Reserve held interest rates steady at 4.25 to 4.50%, in-line with expectations. Fed Chair Powell mentioned that tariffs will likely increase inflation and slow down economic growth. The latest CME FedWatch Tool showed a 17% probability of a June rate cut in the US. The Bank of England reduced interest rates by 0.25% to 4.25%. The US and UK announced a limited bilateral trade agreement, including reductions on import taxes on selected auto imports, steel, and aluminum. US and China agreed to roll back tariffs for an initial 90-day period.

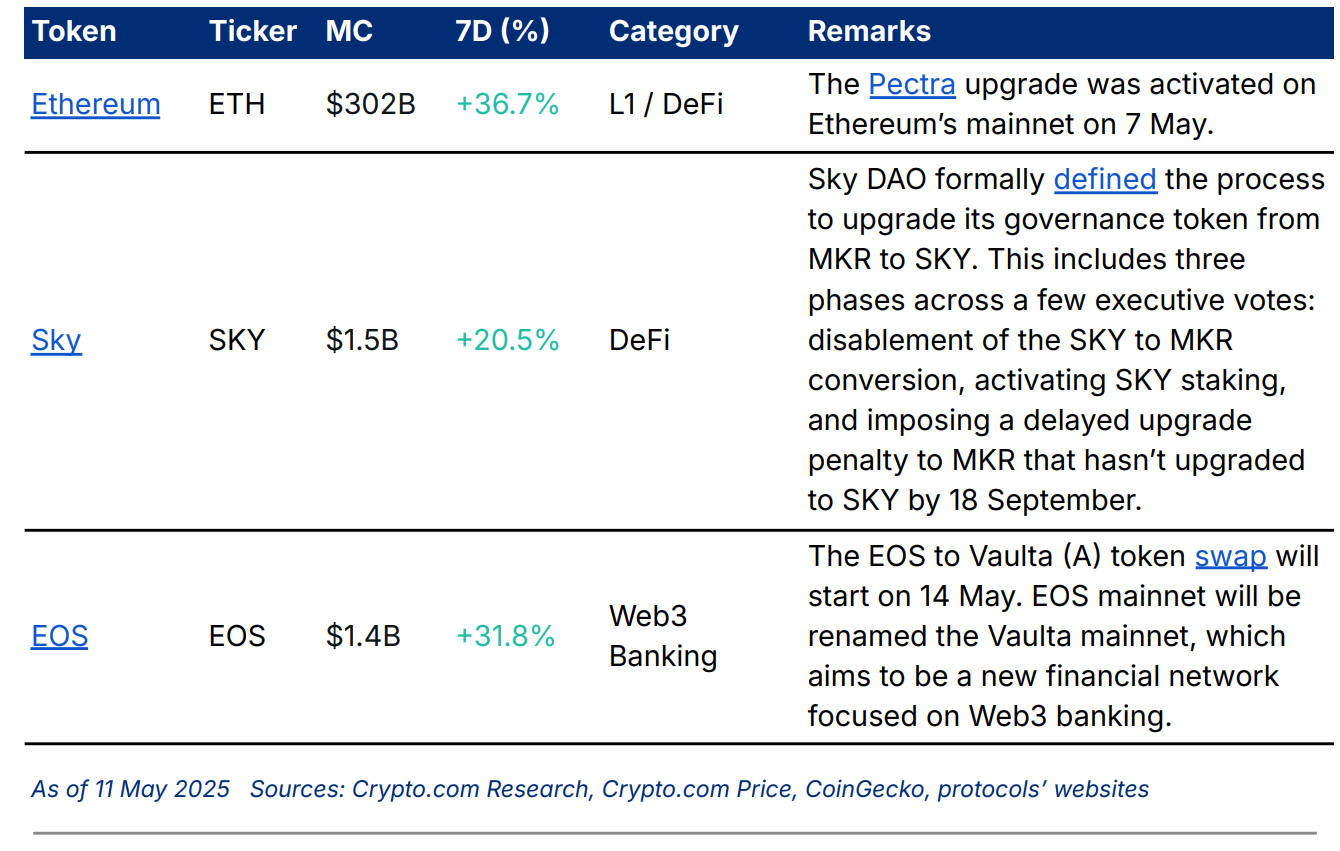

Notable updates: Ethereum’s Pectra upgrade is live on mainnet; Sky DAO (SKY) formally defined the process to upgrade its governance token from MKR to SKY; EOS to Vaulta (A) token swap will start on 14 May; the Crypto.com App listed Hyperlane (HYPER), ai16z (AI16Z), and Doodles (DOOD)

Notable events in the coming week: US Consumer and Producer Price Index, Fed Chair Powell’s speech

Weekly Market Index

Price, volume, and volatility indices were up by +12.04%, +74.04%, and +29.19%, respectively.

Price increase was led by ARB (+41.52%) and ETH (+36.69%). Volume increase was led by ARB (+153.34%), DOGE (+94.16%), and ETH (+93.88%). This coincided with Ethereum’s Pectra upgrade, which went live on the Ethereum mainnet and Arbitrum Sepolia on 7 May. Pectra had a more direct focus on users and validator experience on Layer-1. For users, it allows externally owned accounts (e.g., individual wallets) to execute smart contracts introduced in EIP-7702 for supporting account abstraction. For validators, it consolidates and reduces the number of validators by increasing the maximum balance that validators can stake from 32 ETH to 2,048 ETH.

Chart of the Week

Ether’s price surged 21% to nearly $2,200 last Thursday after the Pectra upgrade, marking its biggest daily gain since May 2021, and ended the week above $2,500. This also aided in reversing the ETH/BTC ratio, which dropped from 0.035 at the beginning of 2025 to a low of 0.018 in mid-April, back to 0.024 as of 11 May.

Weekly Performance

BTC and ETH increased by +8.9% and +36.7%, respectively, in the past seven days. All other large-cap tokens increased in price, which coincided with progress in US trade negotiations with the UK and China.

All key categories increased in market capitalisation in the past seven days, led by the Meme category.

Notable Token Updates

Newly Listed Tokens in Crypto.com App

News Highlights

Crypto.com / Cronos News

21Shares launched a Cronos (CRO) ETP in Europe. The instrument is listed on Euronext's Paris and Amsterdam exchanges, allowing investors to gain regulated exposure to the Cronos ecosystem.

Emirates Petroleum Company PJSC (Emarat) and Crypto.com partnered to enable crypto services at Emarat service stations, subject to regulatory approval. In addition, through Project Landmark, the two companies will unveil the Crypto.com Emarat Service Station at Emarat’s Al Ameen Station on Al Wasl Road.

Crypto.com Exchange joined Lynq, the real-time yield-bearing settlement network, as a launch partner. Other partners include B2C2, Galaxy, and Wintermute. This will allow Crypto.com’s institutional clients to seamlessly and efficiently fund their trading accounts and off-ramp to the settlement platform with one click.

Adoption

Citi and Switzerland’s SIX Digital Exchange (SDX) partnered to tokenise, settle, and safekeep traditional private markets. The partnership will leverage SDX’s Central Securities Depositary (CSD) platform and is expected to go live in Q3 2025, which will make pre-IPO equities available to eligible investors.

Investment Vehicles

Bitwise filed to list a spot Near Protocol (NEAR) ETF with the US Securities and Exchange Commission (SEC), adding to the list of altcoin ETFs currently pending approval.

Regulation

The US state of New Hampshire became the first to allow its treasury to use funds to invest in crypto with a market capitalisation above $500 billion. This came after its governor signed a bill passed by the legislature into law.

The US state of Arizona’s governor signed a bill to establish a reserve fund for bitcoin and other digital assets, which allows it to keep crypto if the owner failed to claim it within three years.

The US state of Texas’s House Committee passed a bill to create a bitcoin reserve, which is now pending a full floor vote before passing it to the governor.

The US Office of the Comptroller of the Currency (OCC) said that national banks are allowed to buy and sell customers’ crypto assets on their behalf. The banks can also outsource crypto custody and trade execution to third parties.

The US SEC is considering exempting companies that issue tokenised securities from certain registration requirements. For example, decentralised exchanges may no longer need to register as a broker-dealer, clearing agency, or exchange, according to SEC Commissioner Hester Peirce.

Others

BlackRock met with the US SEC Crypto Task Force to discuss staking for crypto exchange-traded products (ETP) and tokenisation of securities. The company previously mentioned that ETH ETFs are “less perfect” without staking.

Recent Research Report

Crypto Card Consumer Spending Insights 2024: A full breakdown of what our community across the globe likes to spend on in 2024.

Wall Street On-Chain Part 3: Trading & Liquidity: This report compares liquidity between popular TradFi assets and major crypto assets, and delves into the development of crypto exchanges.

The Rise of Crypto Treasury: This report examines the conceptual framework, global adoption trends, and stock performance of companies embracing crypto treasuries.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!