🚀 ETH open interest on exchanges hit an all-time high of $21.8 billion on 10 June; Walmart and Amazon are reportedly planning to issue stablecoins

ETH open interest on exchanges hit an all-time high of $21.8 billion on 10 June; Walmart and Amazon are reportedly planning to issue stablecoins; ETF issuers updated S-1 to list spot Solana ETFs

Quick Take

ETH open interest on exchanges hit an all-time high of $21.8 billion on 10 June; Walmart and Amazon are reportedly planning to issue stablecoins; ETF issuers updated S-1 filings to list spot Solana ETFs.

US spot bitcoin ETFs had a net inflow of $1.4 billion last week, reaching $1 trillion in cumulative trading volume since they were launched in January 2024. Spot ether ETFs saw a net inflow of $528 million last week.

On the macro side, the US consumer price index rose 0.1% in May, lower than the Dow Jones estimate of 0.2%. The annual inflation rate was 2.4%, potentially signalling that US President Donald Trump’s recently imposed tariffs have not shown a significant impact on inflation yet. US producer price index rose 0.1% in May, lower than the 0.2% estimate. The latest CME FedWatch Tool showed a 3% probability of a June rate cut in the US compared to 0% last week.

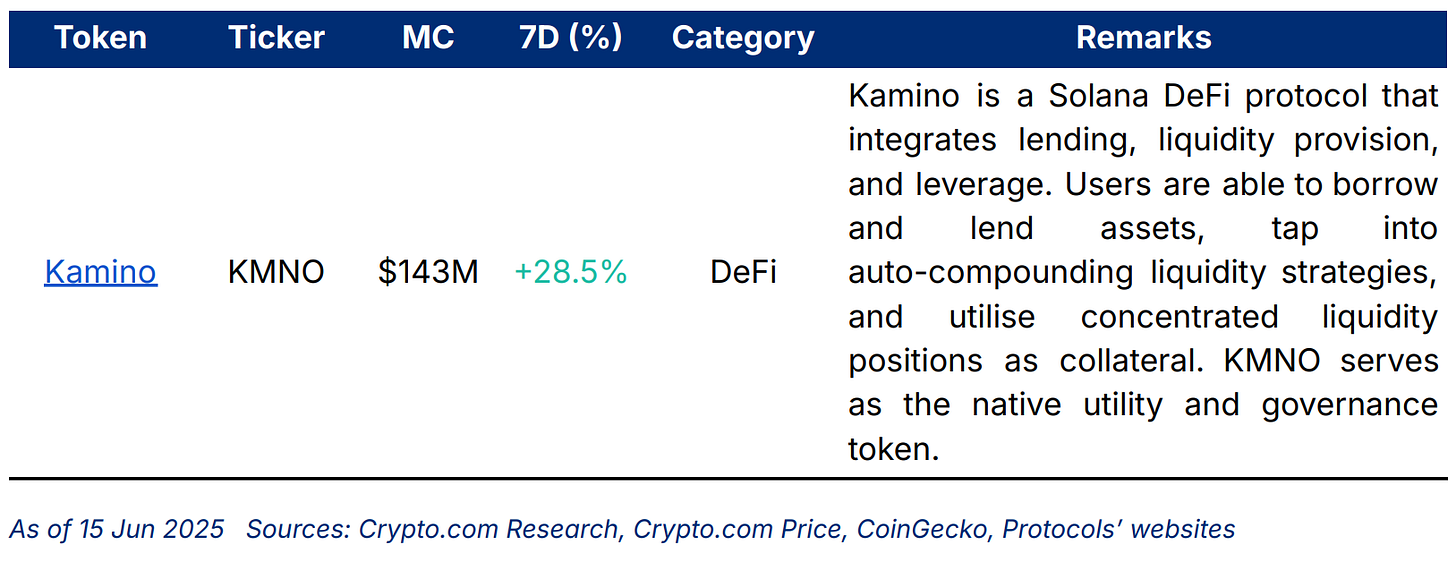

Notable updates: the Crypto.com App listed Kamino (KMNO)

Notable events in the coming week: Interest rate decisions from Japan, Switzerland, UK, and the US

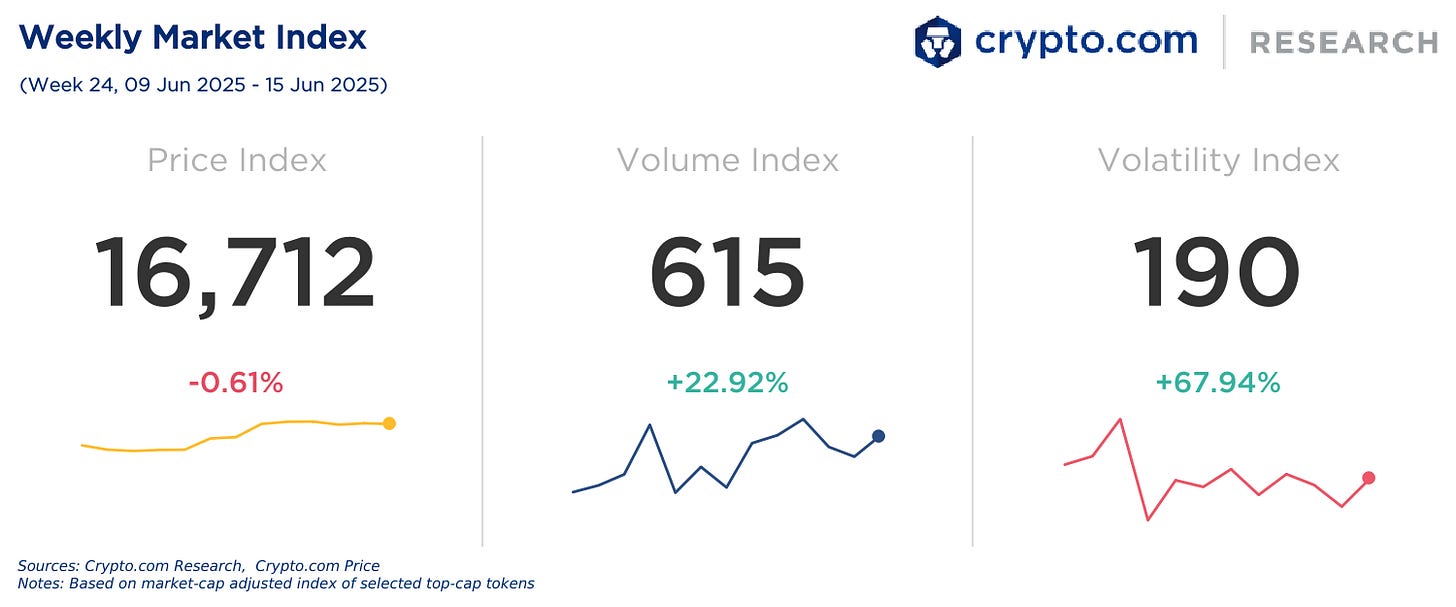

Weekly Market Index

Price index decreased by -0.61%, while volume and volatility indices were up by +22.92% and +67.94%, respectively.

Prices increased at the beginning of last week, which coincided with the US and China reaching a trade deal on tariffs. They retraced toward the end of the week, coinciding with rising geopolitical tension in the Middle East.

Volatility was led by CRO (+342.63%) and ADA (+160.15%). Cardano’s co-founder Charles Hoskinson proposed to convert $100 million of ADA into BTC and stablecoins, which resulted in split community views.

Chart of the Week

ETH open interest (OI) on exchanges hit an all-time high of $21.8 billion on 10 June, up 94% since its lowest point year-to-date in April. ETH’s price rose above $2,800 on the same day, a level unseen since February.

An increase in OI generally suggests a build up of leveraged positions and higher market speculation, which coincided with increased institutional player activity on ETH Chicago Mercantile Exchange (CME) futures.

Weekly Performance

Most top-cap tokens decreased in price last week, led by AVAX and NEAR, which coincided with rising geopolitical tension in the Middle East. BTC and ETH decreased by -4.3% and -5.1%, respectively.

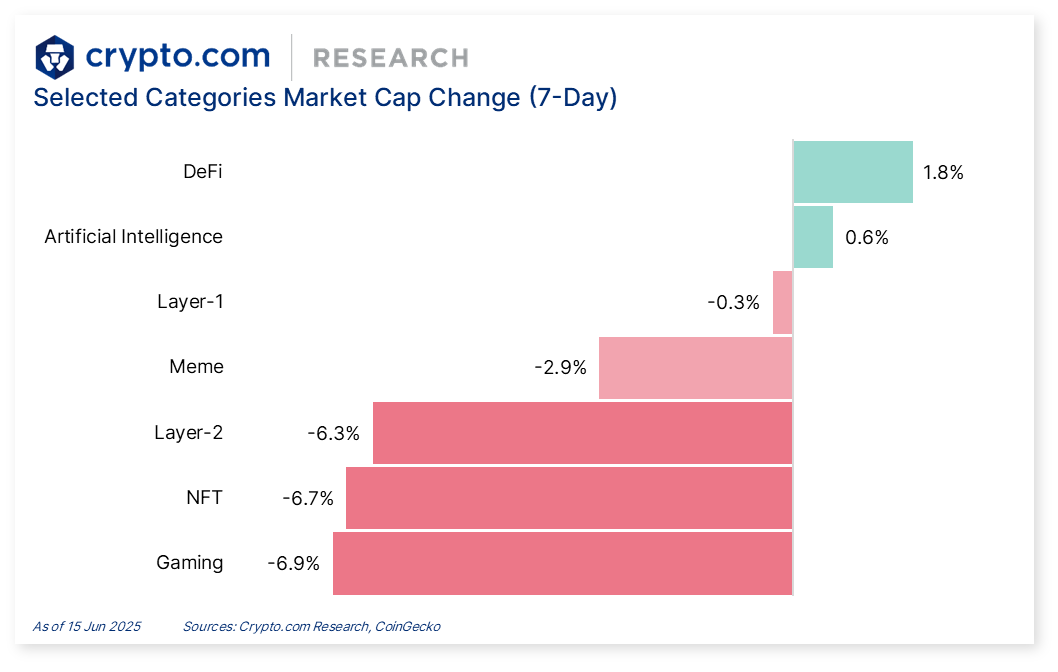

Most key categories decreased in market capitalisation in the past seven days except DeFi and Artificial Intelligence.

Newly Listed Tokens in Crypto.com App

News Highlights

Adoption

Société Générale-Forge, the digital arm of Société Générale, launched a USD-pegged stablecoin named USD CoinVertible (USDCV) on the Ethereum and Solana blockchains. The company previously launched a euro-pegged stablecoin, EUR CoinVertible (EURCV).

Walmart and Amazon are reportedly planning to issue USD-backed stablecoins, signalling broader institutional adoption.

Investment Vehicles

Fidelity Investments filed with the US Securities and Exchange Commission (SEC) for its spot Solana ETF. Additionally, issuers including Franklin Templeton, Galaxy Digital, Grayscale, and VanEck submitted updated S-1 filings to list spot Solana ETFs.

ProShares and Bitwise filed with the US SEC to launch ETFs linked to Circle Internet Group’s shares (CRCL). ProShares’s ProShares Ultra CRCL ETF aims to deliver daily returns that are twice the performance of CRCL, while Bitwise’s Bitwise CRCL Option Income Strategy ETF aims to track CRCL through options strategies.

Franklin Templeton Digital Assets is planning to roll out an “intraday yield” feature on its Benji platform that allows investors to earn yield paid out each calendar day, even on tokenised assets that are held for part of a given day. Additionally, stablecoins can be used to purchase or redeem tokenised securities on the platform.

Regulation

US SEC Chairman Paul Atkins mentioned in a crypto roundtable that the regulator is looking into policies to exempt DeFi platforms from regulatory barriers, and to let on-chain products be brought into the market “expeditiously”.

The US House Committee on Financial Services advanced the Digital Asset Market Clarity (CLARITY) Act, which aims to designate the roles of the SEC and the Commodity Futures Trading Commission in regulating digital assets. The bill will be voted by the full floor soon.

The US Senate is scheduled to vote on the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS) on 17 June. If passed, it can become a legal and regulatory framework for stablecoins in the US.

Brazil introduced a 17.5% tax on all cryptocurrency profits, regardless of where the assets are held. Additionally, losses can be offset within a rolling five-quarter window.

South Korea’s ruling party under the newly elected president Lee Jae-myung proposed the Digital Asset Basic Act to allow local stablecoin issuance with a minimum equity capital of ₩500 million ($368,000). This aims to boost crypto market growth and encourage competition.

The National Assembly of Vietnam approved the Law on Digital Technology Industry, which recognises crypto assets and mandates cybersecurity and anti-money laundering rules. The legislation is expected to take effect on 1 January 2026.

Ukrainian lawmakers submitted a bill to the parliament to create a crypto reserve. The bill will allow the country’s National Bank to include "virtual assets in the gold and foreign exchange reserves". It aims to encourage financial innovation and strengthen macroeconomic stability.

Recent Research Report

Interest Rate Derivatives and Pendle: Pendle Finance innovates by allowing users to tokenise and trade the yield component of yield-bearing assets separately from the principal, unlocking new liquidity and yield management strategies.

Crypto Options: Crypto options are similar to traditional finance (TradFi) options, except the underlying assets are crypto or crypto-related contracts. Compared to the crypto spot and futures markets, crypto options still represent a small but growing market.

Research Roundup Newsletter [May 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into ‘Crypto Options’ and ‘Interest Rate Derivatives and Pendle’.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!