🤝 Crypto.com acquired Abu Dhabi-based brokerage firm Orion Principals Limited; BlackRock recommends up to a 2% bitcoin allocation in a multi-asset portfolio

Crypto.com acquired Abu Dhabi-based brokerage Orion; Crypto.com partners with Deutsche Bank on corporate banking services; BlackRock suggests up to a 2% BTC allocation in multi-asset portfolios

Quick Take

Crypto.com acquired Abu Dhabi-based brokerage firm Orion Principals Limited; Crypto.com is partnering with Deutsche Bank on corporate banking services; BlackRock recommends up to a 2% bitcoin allocation in a multi-asset portfolio.

US spot bitcoin ETFs had a weekly net inflow of US$2.2 billion last week and marked 12 consecutive days of net inflow on 13 December. Spot ether ETFs saw a weekly net inflow of $855 million — the highest since the ETFs launched. The ETFs also saw 15 consecutive days of net inflow on 13 December.

On the macro side, several central banks announced interest rate cuts last week: Canada (reduce 0.5% to 3.25%), the European Union (reduce 0.25% to 3.15%) and Switzerland (reduce 0.5% to 0.5%). The Reserve Bank of Australia kept interest rates unchanged at 4.35%. China eased its monetary policy stance last week, embracing a “moderately loose” policy instead of a “prudent” stance, potentially suggesting a greater willingness to pledge stimulus measures and cut interest rates. The US inflation rate was 2.7% in November 2024 compared to twelve months prior, up from 2.6% in October and in line with expectations. The latest CME FedWatch Tool showed a 93% probability of a December rate cut in the US, compared to 83% last week.

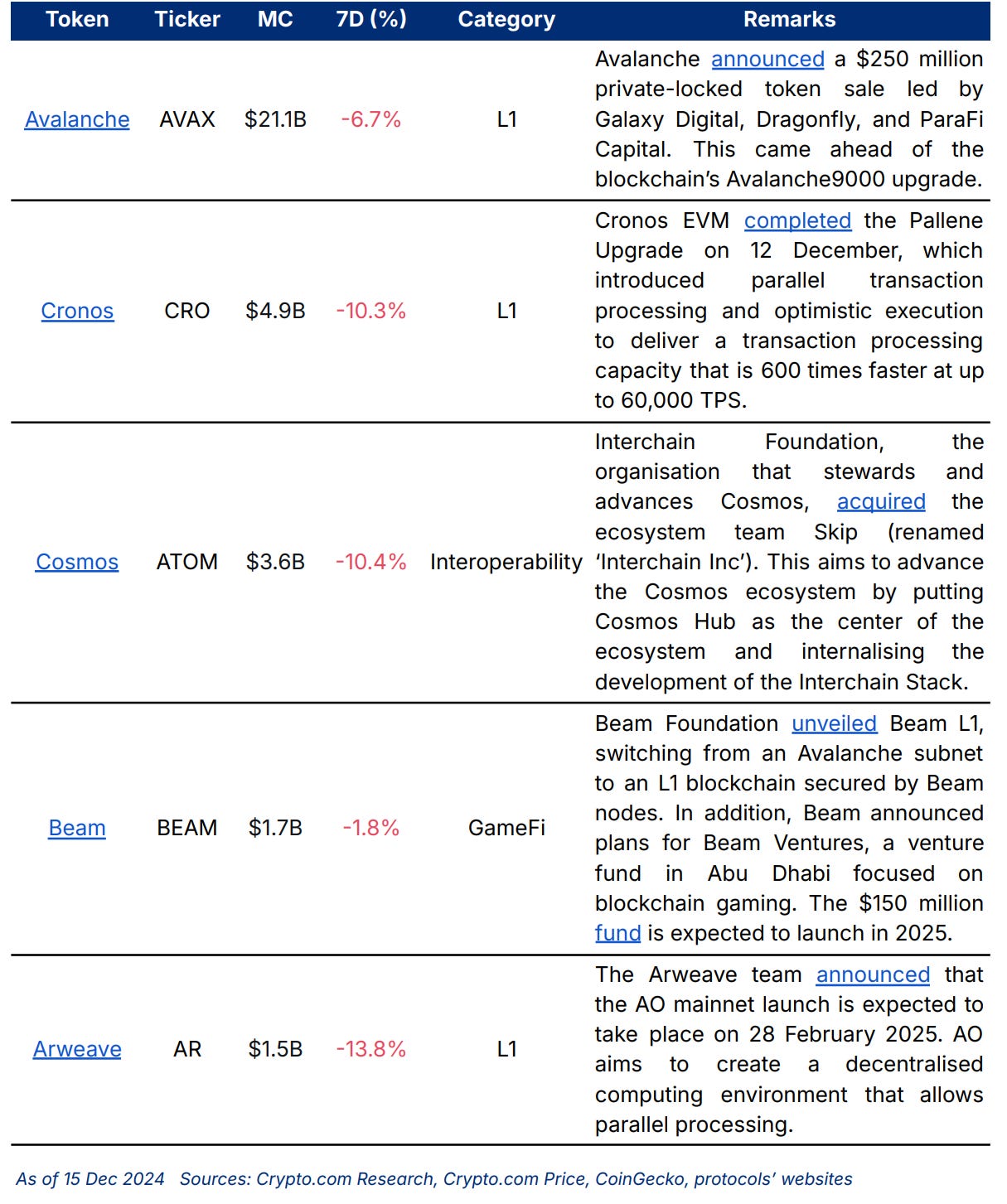

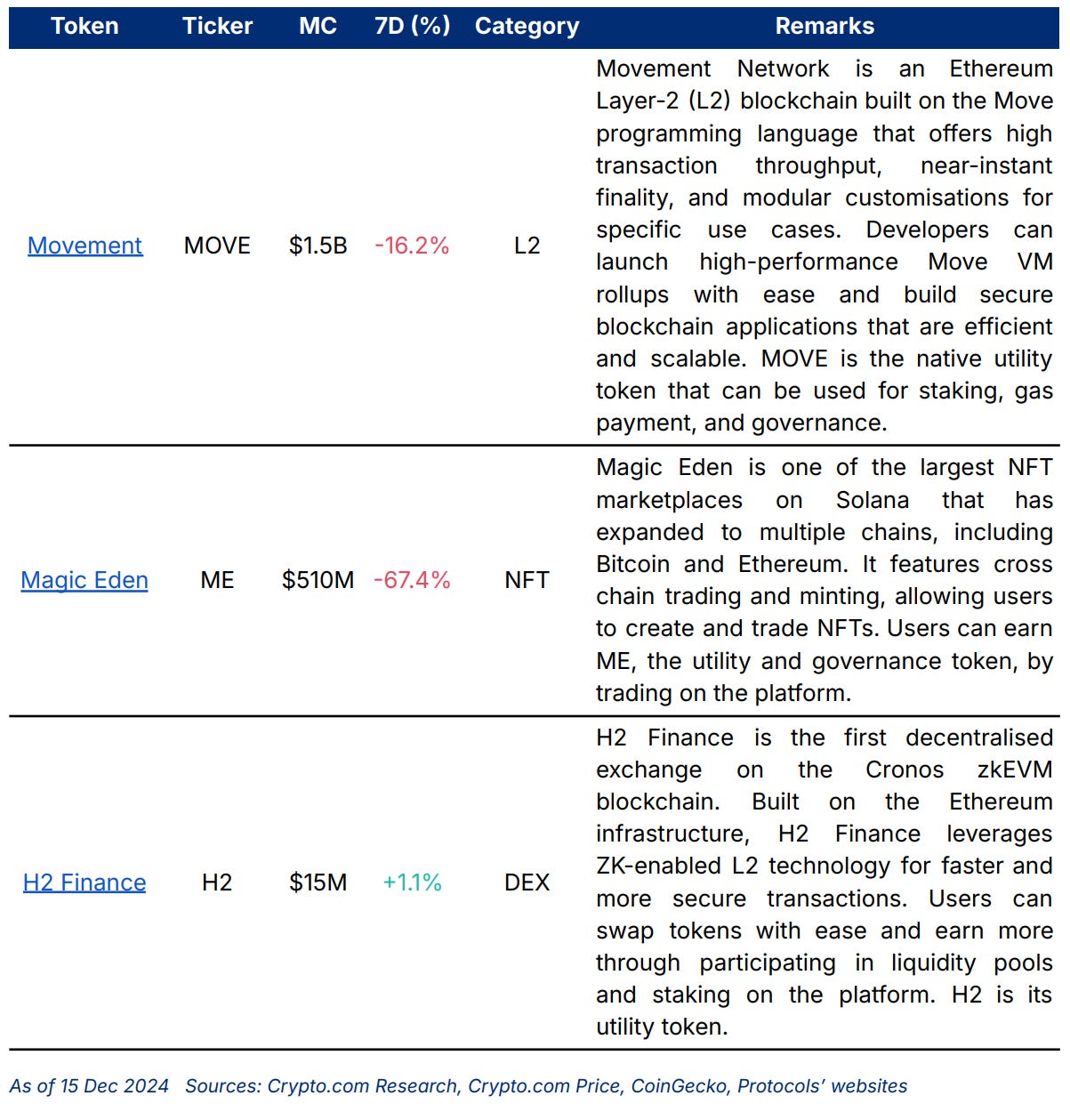

Notable updates: Avalanche (AVAX) announced a $250 million private-locked token sale; Interchain Foundation, the organisation that stewards and advances Cosmos (ATOM), acquired Skip; Cronos EVM completed the Pallene Upgrade; Arweave’s (AR) AO mainnet launch is expected on 28 February 2025; Beam Foundation (BEAM) unveiled the launch of Beam Layer-1 (L1) and plans for Beam Ventures; the Crypto.com App listed Magic Eden (ME), H2 Finance (H2), and Movement (MOVE).

Notable events in the coming week: Interest rate decisions from Japan, UK, and US

Weekly Market Index

Price and volatility indices were up by +0.33% and +84.32% last week, respectively, while the volume index decreased by -16.98%.

SUI (+13.38%) and LINK (+11.01%) led the increase. This coincided with SUI partnering with Ant Digital Technologies to tokenise real-world assets, with a focus in the environmental, social, and governance (ESG) space.

World Liberty Financial Initiative, the DeFi project backed by US President-elect Donald Trump, invested around $1 million in LINK and AAVE and $10 million in ETH, according to analytics firm Lookonchain.

Chart of the Week

BlackRock suggests a 1 to 2% portfolio allocation in bitcoin is considered a reasonable range in its recent report. The report analysed a hypothetical portfolio with 60% in stocks and 40% in bonds.

In this traditional portfolio, each of the ‘magnificent seven’ stocks (mega-cap tech stocks including Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) in the MSCI World, when held at their current weights, contributes approximately 4% to the overall portfolio risk on average. The impact is similar to a 1 to 2% allocation in bitcoin. While bitcoin has a relatively low correlation with other assets, its higher volatility results in a comparable effect on total risk contribution.

Our report, Asset Allocation With Crypto, found that a 2% allocation in bitcoin for a more diverse portfolio that includes the S&P 500, Core US Aggregate Bond, Gold, and Real Estate Investment Trust (REIT) can increase yield by around 0.7%. At the same time, it would decrease overall risk or volatility by around 0.16%.

Weekly Performance

BTC increased by +3.2%, while ETH decreased by -1.2%, in the past seven days. Most of the other selected top market capitalisation tokens decreased. SUI and LINK led the rise.

Most key categories decreased in market capitalisation in the past seven days. The L1 category led the rise, while the meme category led the decrease.

Notable Token Updates

Newly Listed Tokens in the Crypto.com App

News Highlights

Crypto.com News

Crypto.com acquired Orion Principals Limited, an Abu Dhabi-based brokerage firm that is licensed by the Abu Dhabi Global Market (ADGM) to provide investment and ancillary services for various financial instruments. This will enable Crypto.com to offer eligible users financial products, including securities, options, futures, and contracts for differences.

Crypto.com announced that Deutsche Bank will provide corporate banking services for Crypto.com in Singapore, Australia, and Hong Kong. In addition, both companies are committed to working closely to provide additional banking support and country coverage as the relationship progresses.

Investment Vehicles

Grayscale launched the Grayscale Lido DAO Trust and Grayscale Optimism Trust, offering exposure to Lido (LDO) and Optimism (OP), respectively. The funds are only available to qualified investors.

Sweden’s Spotlight Stock Market listed 20 new digital asset exchange-traded products (ETPs) by DeFi Technologies Subsidiary Valour. The assets include Aave, Aerodrome Finance, Akash Network, Aptos, Arweave, and Fetch.ai.

Adoption

Tether’s USDT has been approved by the Financial Services Regulatory Authority (FSRA) as an accepted virtual asset in the Abu Dhabi Global Market (ADGM). FSRA-licensed companies in the region can now provide pre-approved USDT services in the ADGM.

Ripple Labs’s RLUSD stablecoin was approved by the New York Department of Financial Services (NYDFS). The stablecoin is pegged 1:1 to USD, and exchange and partner listings will be available soon.

Australian superannuation fund AMP revealed that it invested $27 million in bitcoin in May 2024, around 0.05% of its total assets under management. It is the first major Australian superannuation fund to take such action.

MicroStrategy purchased 21,550 more BTC for $2.1 billion in the week ending 8 December, funded by share sales. The firm now holds 423,650 BTC, more than 2% of the capped 21 million supply. In addition, the firm will soon be included in the Nasdaq-100 Index.

Regulation / Policy

The US state of Texas introduced a bill in the House of Representatives to establish a strategic bitcoin reserve. The proposed bill aims to strengthen the state’s fiscal stability and will allow it to accept taxes, fees, and donations in bitcoin.

Hong Kong is expected to speed up the licensing process for crypto trading platforms, including the Securities and Futures Commission’s (SFC) plan to set up a “consultative panel” for licensed platforms in early 2025.

The Bank of England now requires firms in the region to disclose their current crypto asset holdings, future plans and application of the Basel framework to manage crypto risks by 24 March 2025. This aims to aid the authorities in the development of crypto policies.

Ukraine reportedly plans to legalise crypto in early 2025 in coordination with the National Bank of Ukraine (NBU) and the International Monetary Fund (IMF). Standard taxation rules similar to securities trading are expected to be applied under the framework.

El Salvador and Argentina signed an agreement to strengthen digital asset industries in both countries. El Salvador is also discussing similar agreements with over 25 other countries.

Others

A critical vulnerability of the Dogecoin network was exploited on 12 December, causing 69% of its nodes to crash. Andreas Kohl, co-founder of bitcoin sidechain Sequentia, claimed he was responsible for the crash. Data from Blockchair indicated that there were 647 active nodes before the hack, and by the time the vulnerability was reported by @EfficiencyDOGE on X, the figure dropped to 205. At the time of writing, there are 383 active nodes.

Recent Research Report

Alpha Navigator: Quest for Alpha [November 2024]: Crypto led the rise, with BTC reaching an all-time high above $100,000 on 5 December. Fixed Income also increased while Equities had mixed performances. The US, UK, and New Zealand reduced interest rates; China kept interest rates unchanged.

Tokenised BTC: This report provides a comparative overview of tokenised BTC, examining the key benefits and challenges associated with different models, as well as the disruptive impact of new market entrants like CDCBTC.

Ethereum Pectra Upgrade: The Pectra upgrade aims to address Ethereum’s mainnet performance with three key objectives: fix existing network issues, improve user experience, and prepare for future upgrades.

Recent University Articles

What Is Solana’s Proof of History? SOL’s Unique Consensus Mechanism: Proof of History (PoH) is Solana’s consensus mechanism that enables faster transaction processing and improved scalability. Here’s how it works.

Ethereum vs Ripple — What Are the Differences, and What’s Next?: Explore the key differences between Ethereum and Ripple, two blockchain heavyweights revolutionising decentralised apps and cross-border payments.

Solana Tokenomics: Everything to Know: Solana’s tokenomics is based on staking incentives, vesting schedules, and inflation controls. Here’s how it works.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!