📈 ETH held in strategic reserves reached nearly 1% of circulating supply; Crypto.com Exchange will accept BlackRock’s BUIDL as trading collateral

ETH held in strategic reserves reached nearly 1% of circulating supply; Crypto.com Exchange will accept BlackRock’s BUIDL as trading collateral; the US Senate passed the GENIUS Act.

Quick Take

ETH held in strategic reserves reached nearly 1% of circulating supply; Crypto.com Exchange will accept BlackRock’s BUIDL as trading collateral; the US Senate passed the GENIUS Act.

US spot bitcoin ETFs had a net inflow of $1.3 billion in the past five trading days, compared to $1.4 billion the week before. Spot ether ETFs saw a net inflow of $38 million in the same period, lower than $528 million the week before.

On the macro side, the US Fed kept interest rates steady at 4.25 to 4.50%. The Fed dot plot indicated two 0.25% reductions are expected in 2025. Compared to projections from March, the 2025 US GDP growth forecast was revised down by 0.3% to 1.4%, while the core personal consumption expenditures price index was revised up by 0.3% to 3.1%. The latest CME FedWatch Tool showed a 16% probability of a July rate cut in the US. The Bank of England and Bank of Japan kept interest rates steady at 4.25% and 0.5%, respectively. The Swiss National Bank cut interest rates by 0.25% to 0%.

Notable updates: The Crypto.com App listed SPX6900 (SPX) and Spark (SPK)

Notable events in the coming week: US Fed Chair Powell’s testimony, US Core Personal Consumption Expenditures Price Index

Weekly Market Index

Price and volume indices decreased by -7.93% and -9.44%, respectively, while volatility index was up by +27.19%.

All tokens in the weekly market index dropped in price last week amid rising tension in the Middle East. Volatility was led by XRP (+91.02%) and CRO (+58.89%). Canadian asset manager 3iQ launched an XRP-focused ETF on the Toronto Stock Exchange.

Chart of the Week

The amount of ether held in strategic reserves reached 1,189,335 ETH, accounting for 0.9854% of the total circulating supply, according to the latest figure reported by Strategic ETH Reserve.

Thirty-eight participants were identified as strategic ETH holders, with the top five holding over 70% of the ETH in strategic reserves. 32% was held by foundations (e.g., Ethereum Foundation), 31% by public companies, 14% by decentralised autonomous organisations, 5% by government reserves, and 17% by others (e.g., private companies). The Ethereum Foundation held the most with 259,440 ETH, followed by the public company SharpLink Gaming (NASDAQ: SBET) with 176,271 ETH. This potentially suggests Ethereum’s rising importance among institutions.

Weekly Performance

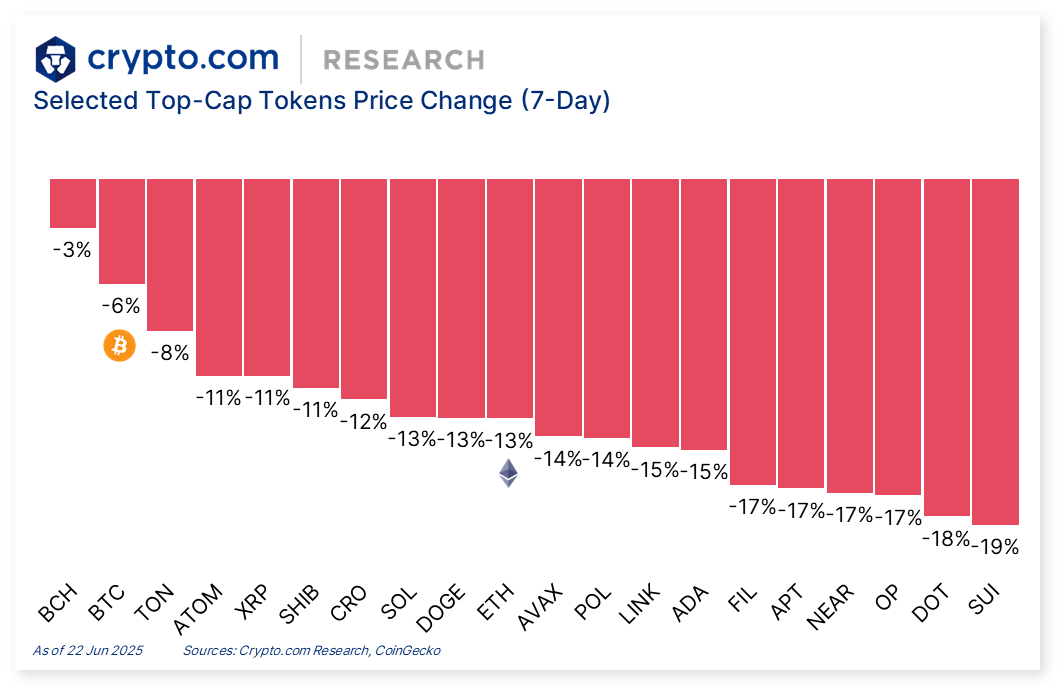

All top-cap tokens decreased in price last week, led by SUI and DOT, which coincided with rising geopolitical tension in the Middle East. The Polkadot community had mixed reactions on a governance proposal to convert 500,000 DOT to Threshold Bitcoin (tBTC) for diversification.

BTC and ETH decreased by -5.7% and -13.0%, respectively.

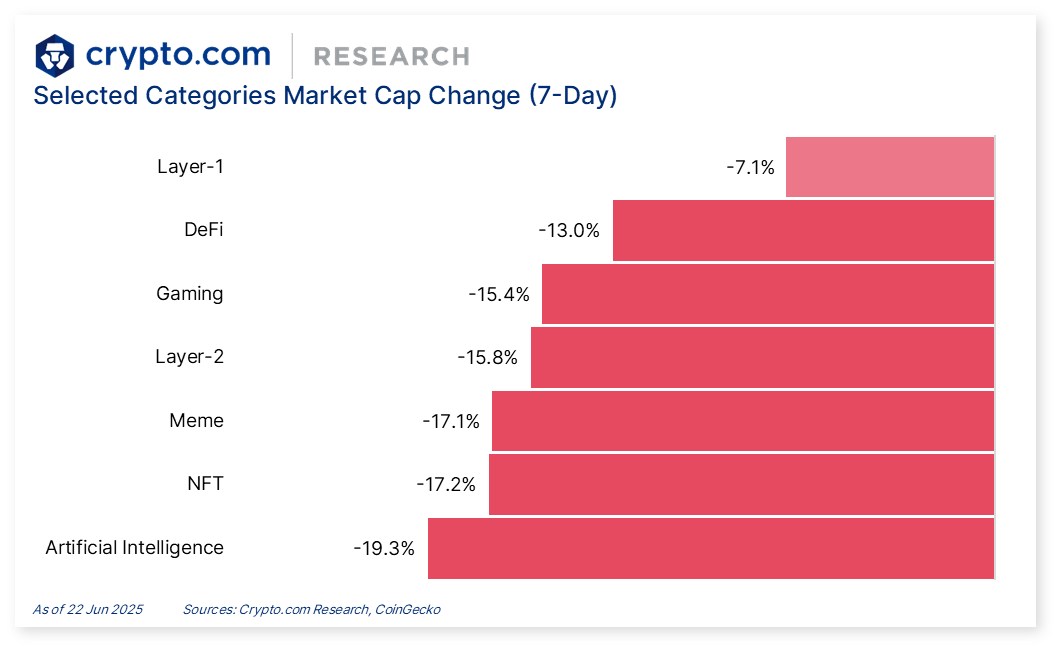

All key categories decreased in market capitalisation in the past seven days. The artificial intelligence category led the drop.

Newly Listed Tokens in Crypto.com App

News Highlights

Crypto.com / Cronos News

The Crypto.com Exchange will accept BlackRock’s tokenised fund, BlackRock USD Institutional Digital Liquidity Fund (BUIDL), as collateral to secure margin for trading, available to qualified institutional clients and advanced traders.

Truth Social, US President Donald Trump’s social media platform, filed with the US Securities and Exchange Commission (SEC) to launch a dual bitcoin and ether ETF. Crypto.com and its affiliates will be the liquidity provider, and bitcoin and ether custodian of the ETF.

Adoption

JP Morgan Chase applied for a trademark for a stablecoin-like asset named JPMD for institutional clients. It is expected to be a system for digital asset trading, and transfer and payment services, with use cases including asset issuance and fund transfers.

Chinese e-commerce company JD.com plans to obtain stablecoin licenses in major sovereign currency countries globally. This aims to reduce cross border payment costs and facilitate business-to-business transfers.

The Wyoming Stable Token Commission, a state-backed group, targets 20 August for the mainnet launch of its WYST stablecoin. WYST is expected to be a USD-pegged stablecoin authorised by the Wyoming Stable Token Act, representing the state’s aim to establish itself as a blockchain leader.

Ethena Labs and Securitize partnered to enable 24/7 transfers between Blackrock’s tokenised fund BUIDL and Ethena’s stablecoin USDtb. This service is available for qualified participants onboarded via Securitize.

Malaysia launched a Digital Asset Innovation Hub Initiative, a regulatory sandbox for testing new technologies, under the oversight of the central bank. It will enable use cases including programmable payments, ringgit-backed stablecoins, and supply chain financing.

Investment Vehicles

CoinShares filed an S-1 with the US SEC to list shares of a spot Solana ETF, representing the eighth issuer to seek SEC approval.

VanEck’s proposed spot Solana ETF was listed on a page maintained by the Depository Trust and Clearing Corporation tracking active and pre-launch funds. The fund cannot be created or redeemed until it receives regulatory approval, but serves as a potential indication that the US SEC may approve the fund soon.

Canadian asset manager 3iQ launched an XRP-focused ETF on the Toronto Stock Exchange, which is available for North American users. Ripple was an early investor in the fund.

Regulation

The US Senate passed the GENIUS Act, advancing efforts to establish a regulatory framework for stablecoins. The bill will be passed to the House of Representatives.

The US state of Texas became the third state after New Hampshire and Arizona to establish a strategic bitcoin reserve. Texas is the first to create a standalone publicly-funded reserve outside of the state treasury.

Thailand approved a tax measure to exempt sale of crypto assets from capital gains tax until 31 December 2029. This is part of the efforts to establish the country as a global digital asset hub.

South Korea’s Financial Services Commission has reportedly submitted a roadmap to the Presidential Committee to prepare for the implementation of local spot crypto ETFs in the second half of 2025. These products were previously banned from being traded or issued.

The US state of Arizona revived a bill which would allow the state to create a ‘Bitcoin and Digital Assets Reserve Fund’ to manage forfeited digital assets. In addition, the US state of Ohio’s House of Representatives passed a bill that will exempt crypto transactions below $200 from capital gains tax, which will subsequently head to the Senate for voting.

Recent Research Report

Interest Rate Derivatives and Pendle: Pendle Finance innovates by allowing users to tokenise and trade the yield component of yield-bearing assets separately from the principal, unlocking new liquidity and yield management strategies.

Crypto Options: Crypto options are similar to traditional finance (TradFi) options, except the underlying assets are crypto or crypto-related contracts. Compared to the crypto spot and futures markets, crypto options still represent a small but growing market.

Research Roundup Newsletter [May 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into ‘Crypto Options’ and ‘Interest Rate Derivatives and Pendle’.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!