📈 BTC and ETH futures open interest on exchanges hit record-highs; Crypto.com acquired financial exchange and brokerage firm Charterprime

BTC and ETH futures open interest on exchanges hit record-highs; Crypto.com acquired brokerage firm Charterprime and extends its Visa card to Latin America; Options on US Bitcoin ETFs began trading.

Quick Take

BTC and ETH futures open interest on exchanges hit record-highs; Crypto.com acquired Charterprime Ltd., a global financial exchange and brokerage licensed by the Financial Services Commission of Mauritius; Crypto.com extends visa card to Latin America; Options on US Bitcoin ETFs began trading.

US spot bitcoin ETFs had a weekly net inflow of $3.4 billion last week, the largest weekly inflow since the ETFs launched. The ETFs surpassed US$100 billion in net assets for the first time on 21 November. Spot Ether ETFs had a weekly net outflow of $68 million.

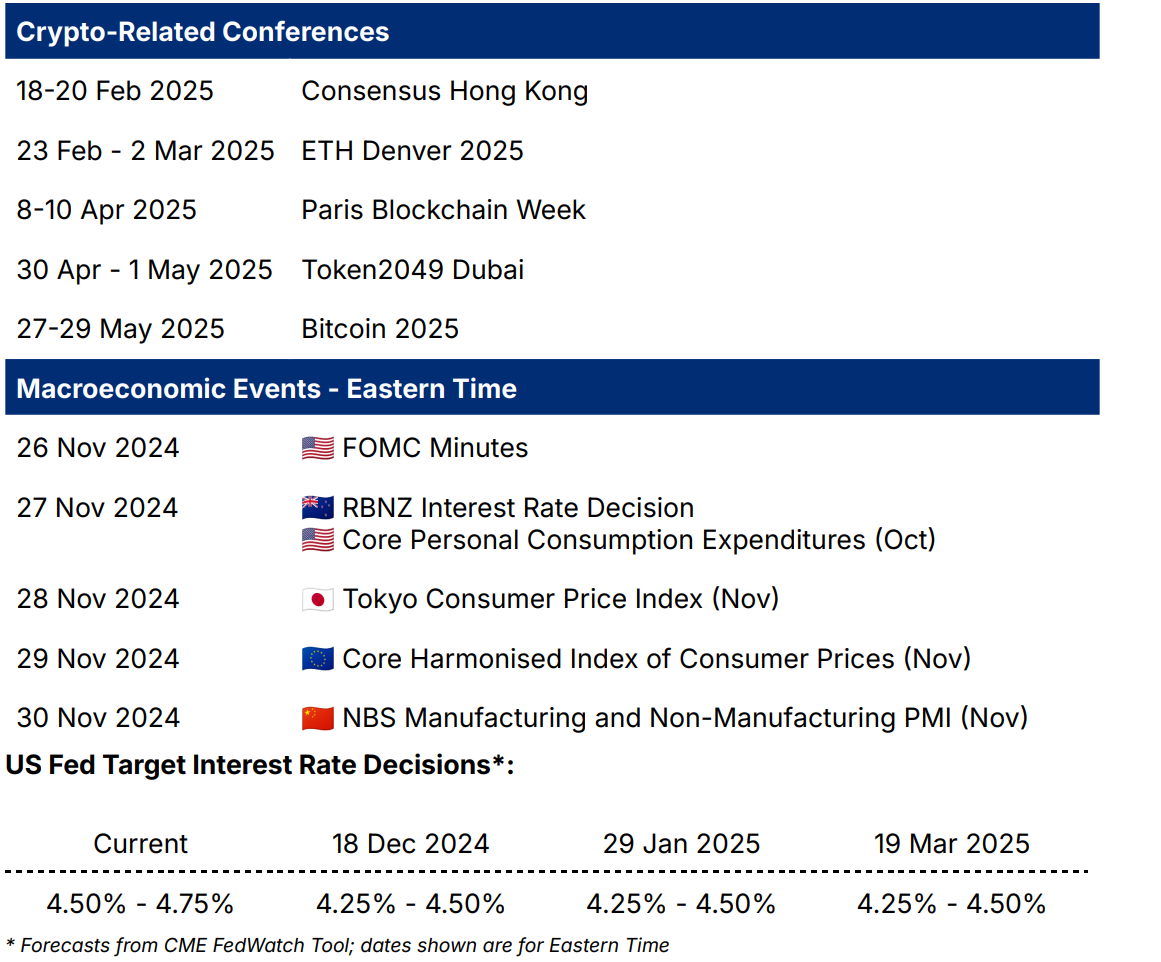

On the macro side, the US S&P Global Manufacturing & Services PMI, which measures US business activities, increased to 55.3 in November, the highest level since April 2022. The latest CME FedWatch Tool showed a 51% probability of a December rate cut in the US (vs 65% last week). The EU HCOB Composite PMI fell to 48.1, a ten-month low in November, suggesting a market contraction. This coincided with the EUR falling to a two-year low against USD last Friday.

Notable updates: The Graph (GRT) introduced the GRC-20 standard; the Crypto.com App listed Chill Guy (CHILLGUY) and Capybara Nation (BARA)

Notable events in the coming week: US FOMC Minutes, Core Personal Consumption Expenditures Price Index, and RBNZ Interest Rate Decision

Weekly Market Index

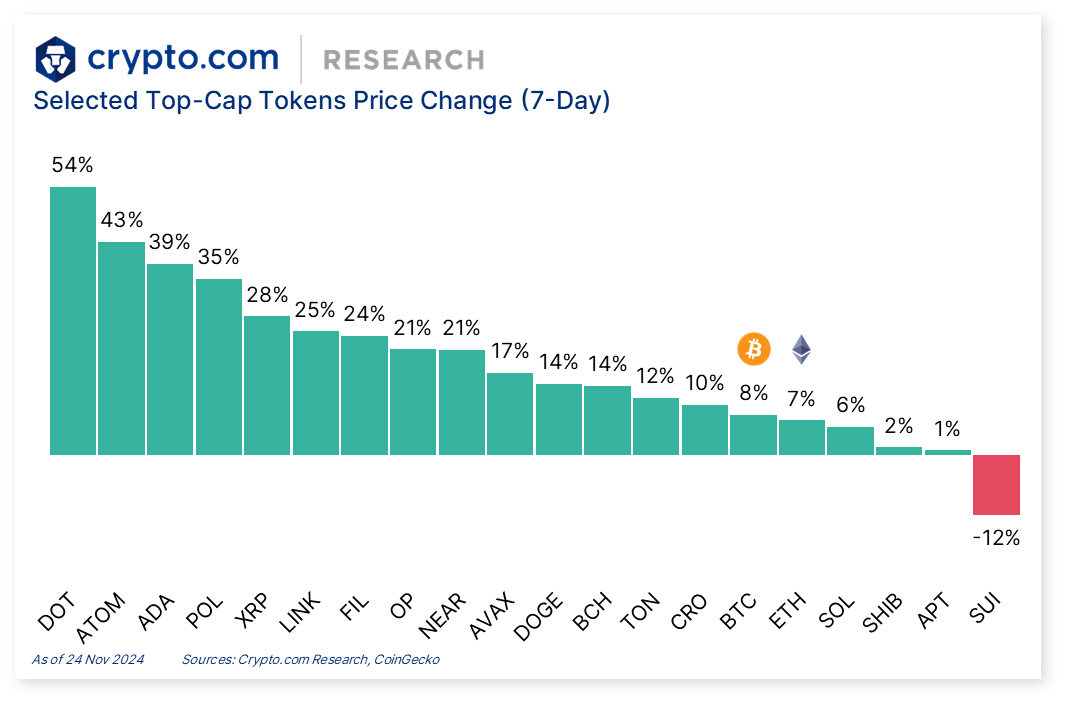

Price index was up by +7.27% last week, while volume and volatility indices decreased by -19.74% and -34.60%, respectively. The price increase was led by DOT (+54.1%) and ATOM (+42.9%). This coincided with the collaboration between FIFA and Mythical Games (parachain on the Polkadot ecosystem) to launch the blockchain game FIFA Rivals.

Chart of the Week

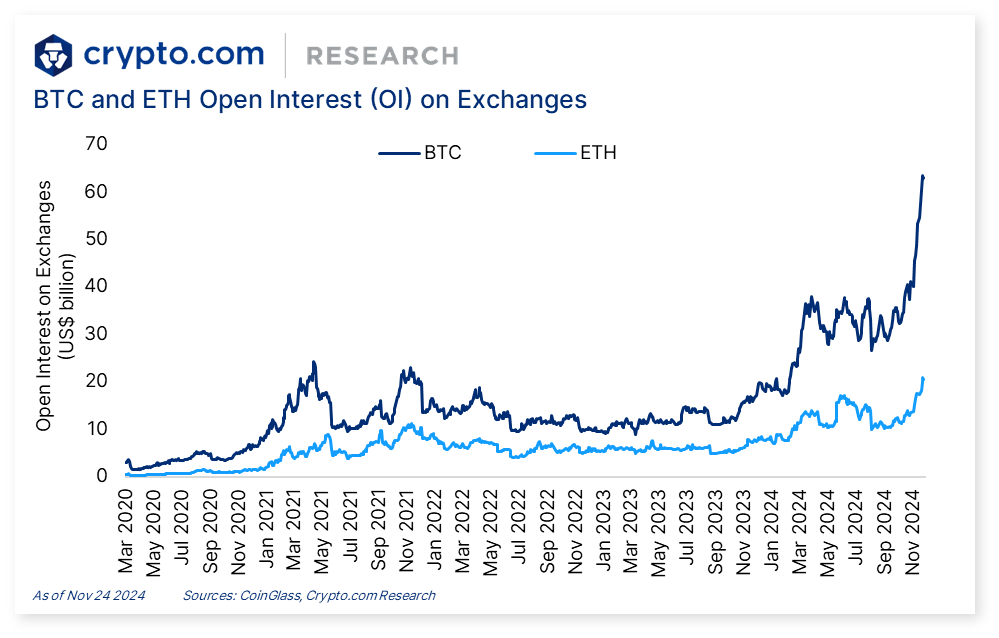

BTC and ETH futures open interest (OI) on exchanges both hit record-highs last week, according to data from CoinGlass. BTC recorded an all-time high OI of $63.5 billion on 23 November, which coincided with its price exceeding the $99,000 level on the same day. ETH recorded an all-time high OI of $20.8 billion on 24 November, with its price rising above the $3,400 level.

BTC/ETH futures OI measures the total number of outstanding contracts that have not been settled or closed in BTC/ETH future contracts, an increase of which typically suggests new money entering the market with bullish market sentiment.

Weekly Performance

BTC and ETH increased by +8.1% and +7.0%, respectively, in the past seven days. Prices for all other selected top market capitalisation tokens increased except SUI (-12.1%). SUI experienced an outage on 21 November, halting block production for more than an hour.

All key categories increased in market capitalisation in the past seven days. The Layer-2 category led the increase.

Notable Token Updates

Newly Listed Tokens in the Crypto.com App

News Highlights

Crypto.com News

Crypto.com acquired Charterprime, a financial exchange and brokerage service that holds an Investment Dealer Licence and a Global Business Licence issued by the Financial Services Commission of Mauritius. This represents the latest step in Crypto.com’s roadmap to bring TradFi and crypto together, and would enable Crypto.com to provide eligible users with a broader offering of financial products.

Crypto.com expanded its Visa card offerings to Latin America, which gives users in the region access to spending rewards and other benefits as part of the Level Up experience.

Crypto.com partnered with Singapore-based digital currency financial institution Triple-A to enable direct crypto payments to an array of online merchants. The service will allow Crypto.com’s customers to make purchases from various e-commerce brands directly from the Crypto.com wallet. The service will commence in Singapore.

Investment Vehicles

Nasdaq listed options on BlackRock’s iShares Bitcoin Trust ETF (IBIT) on 19 November, with $1.9 billion in trading volume on the first day. This marked the first US spot bitcoin ETF to launch options. Bitwise and Grayscale also launched options trading on their ETFs (Bitwise’s BITB and Grayscale’s GBTC and BTC) on 20 November.

Cboe BZX Exchange submitted four 19b-4 filings for VanEck, Bitwise, 21Shares, and Canary Capital to list spot Solana ETFs, subject to approval from the US Securities and Exchange Commission (SEC). In addition, Bitwise filed an S-1 for its Bitwise Solana ETF with the SEC on 21 November.

Cboe Global Markets announced plans to launch the first cash-settled index options based on the Cboe Bitcoin US ETF Index, which tracks the performance of US spot bitcoin ETFs. The options are scheduled to launch on 2 December.

Grayscale completed reverse share splits of its Grayscale Bitcoin Mini Trust ETF (BTC) and Grayscale Ethereum Mini Trust ETF (ETH). The ETFs, BTC and ETH, saw their price per share increase by five times and ten times, respectively, after the split. The company’s aim is to make securities trading more cost-effective for investors.

MicroStrategy completed a $3 billion offering of 0% convertible senior notes that are due 2029, with investors including Germany’s insurer Allianz. The proceeds are intended to acquire additional BTC and for general corporate purposes.

Adoption

Franklin Templeton partnered with Layer-1 blockchain Sui (SUI) to explore new blockchain technologies and use cases. The partnership will support builders on Sui and develop new technologies using the Sui protocol.

Stripe expanded its crypto products to Layer-1 blockchain Aptos (APT) and USDC stablecoin plans to launch on Aptos. This aims to aid transfers between traditional payment systems and blockchains, as well as enhance DeFi applications on Aptos.

Mastercard’s Multi-Token Network (MTN) is connecting with JPMorgan’s Kinexys Digital Payments for a new business-to-business cross-border blockchain payment solution, which aims to improve settlement speed and transparency.

Chainlink, Microsoft, and Banco Inter collaborated on phase two of Brazil’s central bank digital currency (CBDC) pilot. This phase aims to build a trade finance solution using oracles and blockchain technology.

Regulation / Policy

Crypto companies, including Ripple and Circle, as well as venture firms Paradigm and a16z, are competing for seats in US President-elect Donald Trump’s potential crypto advisory council. The council is expected to help guide digital asset policy in the US.

The UK is expected to introduce a unified framework for the crypto sector in early 2025, aiming to integrate regulations for stablecoins and staking services into a single regime.

Recent Research Report

Alpha Navigator: Quest for Alpha [October 2024]: Crypto and Equities had mixed performances in October; Fixed Income was down; BTC led the rise. Canada, China, Eurozone, and New Zealand reduced interest rates; Australia and Japan kept interest rates unchanged.

Crypto Derivatives Trading - Technical Analysis in Perpectuals and CFDs: In this report, we demonstrate how to use popular technical indicators — MACD and RSI — to build trading strategies, with the consideration of margin and trading fees, within the Crypto.com ecosystem.

Research Roundup Newsletter [October 2024]: We present to you our latest issue of Research Roundup, featuring our deep dives into Intent-Based Protocols, Solana Staking and Crypto Derivatives Trading – Technical Analysis in Perpetuals and CFDs.

Recent University Articles

Selecting Range in UpDown Options — A Guide: Setting your range as narrow or wide as preferred can be the deciding factor for a successful UpDown Option contract. Here’s how to choose.

How to Automate Trading in the Crypto.com App: Automate trades in the Crypto.com App with our trading bots that buy, sell, and DCA at target prices or set intervals. Here’s how they work.

Cardano vs Solana: Key Differences and Future Prospects: Speed, dapps, scalability: Who does it better? Find out in our comparison of Solana vs Cardano.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!