₿ Bitcoin reached an all-time high above $109,000 with a trading volume spike on 20 Jan; Crypto.com launched the Crypto.com Exchange in the US

Bitcoin reached above $109,000 with a trading volume spike on Jan 20; Crypto.com launched the Crypto.com Exchange in the US; Nasdaq filed for in-kind redemption for BlackRock’s iShares Bitcoin Trust

Quick Take

Bitcoin reached an all-time high above $109,000 with a trading volume spike on 20 January; Crypto.com launched the Crypto.com Exchange in the US; Nasdaq filed to allow in-kind redemptions for BlackRock’s iShares Bitcoin Trust.

US spot bitcoin ETFs had a net inflow of US$2.8 billion last week (past five trading days). Spot ether ETFs saw a net inflow of $163 million last week.

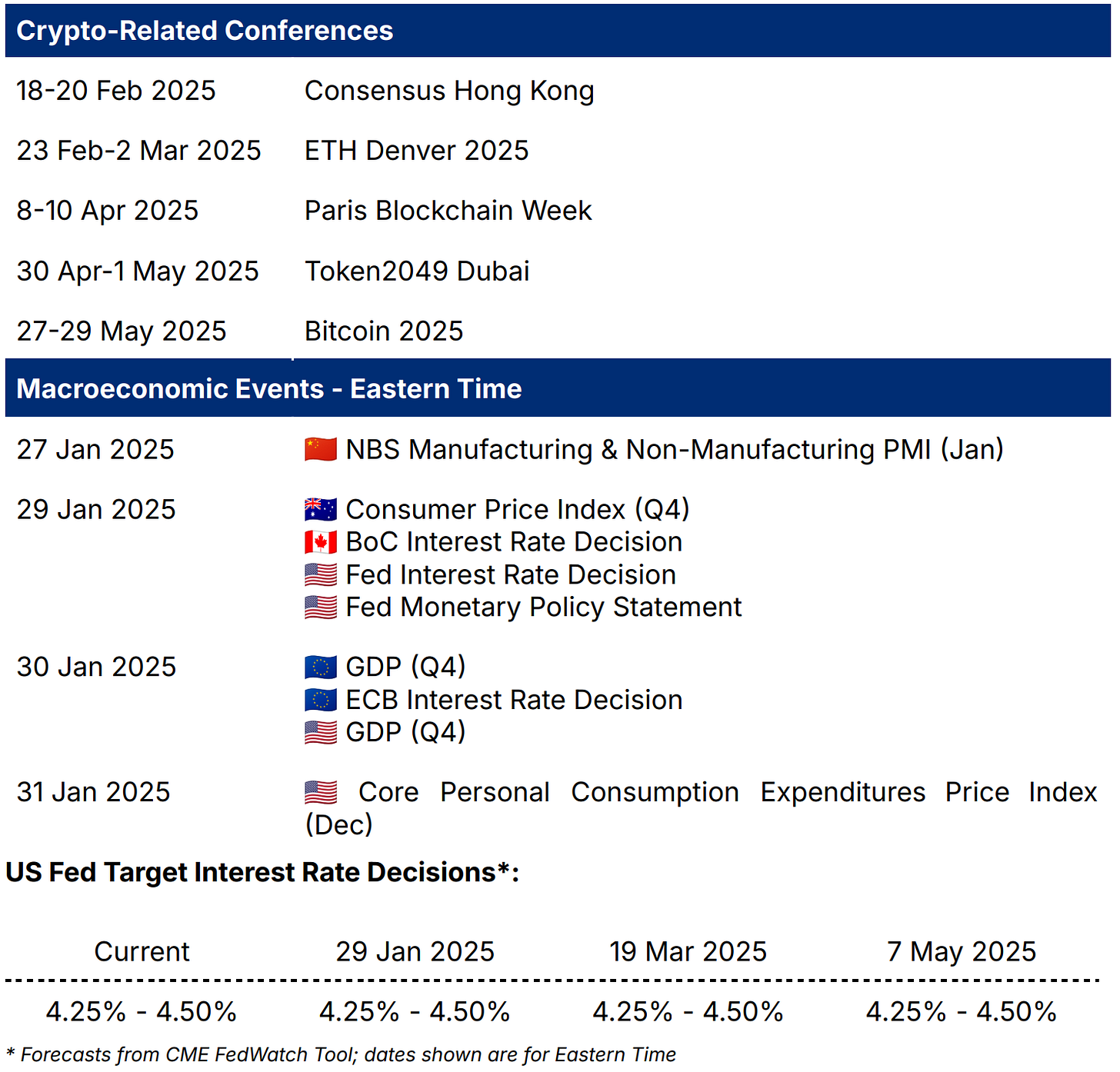

On the macro side, Donald Trump was inaugurated as the 47th US president on 20 January. The latest CME FedWatch Tool showed a 0% probability of a January rate cut in the US (same as last week). The Bank of Japan raised interest rates from 0.25% to 0.5%, the highest level since 2008.

Notable updates: Uniswap (UNI) announced that v4 deployments will be rolling out for builders to test integrations on-chain; the Crypto.com App listed Sonic (S), Vine Coin (VINE), and Animecoin (ANIME).

Notable events in the coming week: Interest rate decisions from US, Eurozone, and Canada

Weekly Market Index

Price and volatility indices decreased last week by -0.84% and -66.60%, respectively. Volume index was up by +5.70%.

The broader cryptocurrency market rallied on 20 January, which coincided with US President Donald Trump’s inauguration, before retracing towards the end of the week. Most of the cryptocurrencies in the index were down last week; LINK (+1.79%) and ATOM (+1.55%) led the increase.

Chart of the Week

Bitcoin reached a new all-time high above $109,000 on 20 January, the day of US President Donald Trump’s inauguration. At the same time, bitcoin’s daily trading volume spiked to $126 billion on the day, according to CoinMarketCap, compared to the $56 billion average month-to-date. This was also the highest daily volume since 5 December 2024, when it reached $149 billion as bitcoin hit the $100,000 milestone.

Weekly Performance

BTC and ETH both decreased by -0.7% in the past seven days. Prices of most other selected top market capitalisation tokens were down.

Key categories showed mixed changes in market capitalisation in the past seven days. Meme category led the decrease.

Notable Token Updates

Newly Listed Tokens in the Crypto.com App

News Highlights

Crypto.com News

Crypto.com launched the Crypto.com Exchange in the US as part of the company’s institutional-grade offering. US institutional traders can now access a technologically advanced crypto trading platform featuring deep liquidity and low latency. This complements the existing Crypto.com App for retail users in the US.

Regulation / Policy

US President Donald Trump signed an Executive Order to strengthen US leadership in digital financial technology. The order includes creating a working group to propose new digital asset regulations and explore the creation of a national digital asset stockpile. It also banned the creation of a central bank digital currency (CBDC) in the US.

The US Securities and Exchange Commission (SEC) announced the formation of a crypto task force to develop a regulatory framework for crypto assets. In addition, the SEC revoked an accounting guidance, Staff Accounting Bulletin (SAB) 121, that required companies to put digital assets under custody as a liability on the balance sheet. SAB 122 was then issued, which directs firms to use Financial Accounting Standards Board rules or International Accounting Standard provisions.

Taiwan’s Financial Supervisory Commission (FSC) plans to issue a draft bill in June for virtual asset service providers (VASP). It will include plans to allow banks to issue stablecoins, so they can be a bridge between fiat and digital currencies.

Investment Vehicles

Nasdaq filed an amended rule filing to allow for in-kind redemptions and creations for BlackRock’s iShares Bitcoin Trust (IBIT). This will act as an alternative to IBIT’s existing cash creation and redemption process.

Blockchain development firm Blockstream unveiled two institutional investment funds, Blockstream Income Fund and Blockstream Alpha Fund, set to launch in Q1. Blockstream Income Fund is expected to pay USD-denominated yield by lending against bitcoin collateral. Blockstream Alpha Fund provides exposure to infrastructure-based revenue streams; for example, Lightning Network node operations.

Multiple issuers submitted registration filings for crypto investment vehicles last week. CoinShares filed registration statements for a Litecoin ETF and XRP ETF. New York Stock Exchange (NYSE) posted filings for Grayscale Litecoin Trust and Grayscale Solana Trust, which included language on converting the trusts to spot ETFs. In addition, Bitwise Asset Management registered a Dogecoin ETF entity in Delaware, which serves as a legal framework that will enable the firm to launch investment products, including ETFs, in the future.

Adoption

Craig Bowser, a senator from the US state of Kansas, introduced a bill which seeks to authorise the Kansas Public Employees Retirement System (KPERS) to invest up to 10% into spot bitcoin ETFs.

Recent Research Report

Crypto Market Sizing Report 2024: Global crypto owners reached 659 million by the end of 2024.

AI Agent Landscape: The AI agents sector has recently taken off, with top tokens showing an exponential increase in market cap in the past few months. This report looks into the AI agent landscape and delves into some major players and emerging use cases.

Performance Review for 2024 Highlighted Projects: In this report, we analyse the price performance of key trends in the cryptocurrency landscape that we covered throughout 2024. Artificial intelligence (AI) emerged as the best-performing sector in 2024.

Recent University Articles

What Is Arbitrage in Crypto Trading?: Learn how crypto arbitrage trading works, as well as its risks, opportunities, and how to capitalise on price differences across exchanges for profits in the 24/7 crypto market.

Dogecoin vs Shiba Inu — Comparing Two Canine-Inspired Meme Coins: Explore the differences between Dogecoin (DOGE) and Shiba Inu (SHIB), two of the most popular meme coins in the crypto space.

What Are Multisig Scams?: Discover how multisig wallet scams work in cryptocurrency, and how to identify warning signs for safe crypto trading.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!