DeFi & L1L2 Weekly — 📈 LetsBONK.fun dominated meme coin trading on Solana; Pump.fun raised $500 million during its PUMP token sale

LetsBONK.fun led the meme coin trading volume on Solana. Pump.fun raised $500M during the PUMP token sale. The Ethereum Foundation will integrate ZK technology into Ethereum within a year.

Quick Take

LetsBONK.fun overtook Pump.fun as the dominant meme coin launchpad on Solana with over 63% market share by volume.

Pump.fun raised US$500 million during its PUMP token sale.

The Ethereum Foundation is working to integrate Zero-Knowledge (ZK) technology into the Ethereum blockchain within a year.

Layer-1 network TAC launched its public mainnet.

Solana-based DeFi lending platform, Kamino, enabled users to borrow crypto using xStocks’s tokenised stocks as collateral.

Trump Media & Technology Group announced a new subscription package with rewards tied to a utility token.

Tether will discontinue USDT redemptions on five legacy blockchains.

The Trump administration ended two federal investigations into Polymarket without filing any charges.

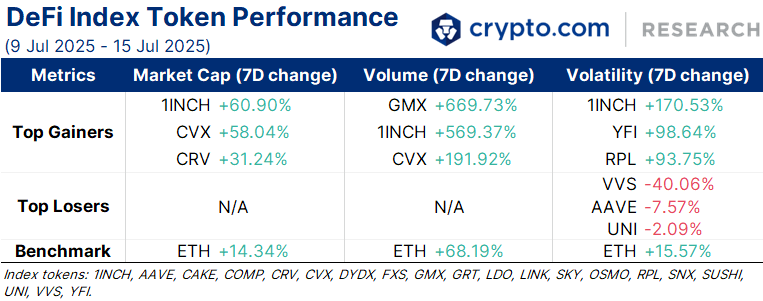

Weekly DeFi Index

This week, the market capitalisation, volume, and volatility indices grew by +18.03%, +79.63%, and +47.18%, respectively.

Decentralised perpetuals exchange GMX was hacked, resulting in over $40 million in stolen funds. The attacker exploited a platform vulnerability to mint GMX's liquidity token, GLP, in abnormal amounts. The hacker returned the stolen funds after accepting a $5 million white hat bounty offered by the GMX team.

Chart of the Week

LetsBONK.fun has emerged as the dominant Solana meme coin launchpad. Launched in April 2025, it aims to democratise meme token creation by eliminating technical barriers with seamless liquidity on Raydium and Jupiter, and stands out with its fee allocation and operational transparency.

The platform charges a 1% fee for each transaction, allocating the income to BONK token repurchase and burn (50%), BONKsol staking (15%), ecosystem development (7.6%), platform operations (7.6%), and other aspects.

LetsBONK.fun overtook Pump.fun in major metrics, including trading volume, number of tokens launched, and platform activity. It averaged around $110 million in daily trading volume, with an average 63% market share over the last 7 days.

News Highlights

The Ethereum Foundation is working to integrate ZK technology into the Ethereum blockchain within a year. This involves replacing traditional block execution with ZK proofs, allowing validators to verify executions using a stateless proof verification from multiple Zero-Knowledge Virtual Machines (zkVMs).

Layer-1 network TAC launched its public mainnet, aiming to bring Ethereum composability to The Open Network (TON) and Telegram. TAC allows Ethereum Virtual Machine decentralised applications (EVM dapps) to interact directly with Telegram users, offering access to DeFi protocols.

Pump.fun raised $500 million in 12 minutes during its PUMP token sale. PUMP has a total supply of 1 trillion, with 33% allocated to the ICO. Additionally, 24% is designated for the ecosystem and future community projects, while another 13% is set aside for existing investors. Within the 33% ICO allocation, 18% has been allocated to institutional investors, while the other 15% is available to retail traders.

Kamino, a Solana-based DeFi lending platform, integrated xStocks into its lending protocol. This allows users to borrow crypto using tokenised stocks as collateral.

Trump Media & Technology Group, the parent company of Truth Social, announced a new subscription package called the ’Patriot Package’ for $9.99 per month. The package offers content from ’non-woke’ news networks and rewards users with ‘gems’ that are tied to a utility token, which will be used to pay for subscription costs and other products.

Tether announced that it will discontinue USDT redemptions on five legacy blockchains, including Omni Layer, Bitcoin Cash SLP, Kusama, Vaulta (previously EOS), and Algorand. The move will take effect on 1 September, and it will allow Tether to focus on more scalable and engaged platforms.

The Trump administration ended two federal investigations into the online prediction market Polymarket without filing any charges. The investigations, one civil and one criminal, were related to Polymarket's acceptance of trades from people in the United States despite promising not to do so. The closure of the probes follows a $1.4 million fine imposed by the Commodity Futures Trading Commission (CFTC).

Recent Research Reports

InfoFi: This report introduces the notable players in the Yap-to-Earn, Attention Market, and Reputation Market categories of InfoFi, as well as the significance and challenges of InfoFi’s development.

Crypto Credit Market: This report offers an overview of the crypto credit market and emphasises the design of a decentralised lending ecosystem. It also examines how traditional financial players are piloting blockchain-based credit frameworks, including experiments with on-chain private credit.

Research Roundup Newsletter [Jul 2025]: We present to you our latest issue of Research Roundup, featuring our deep dives into ‘InfoFi’ and ‘Crypto Credit Market’.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT. The latest crypto market insights are also available via the dashboard.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.