DeFi & L1L2 Weekly — 📈 The weekly trading volume of tokenised gold hit record highs; EigenLayer unveiled EigenCloud to enhance trust and verifiability for apps

Tokenized gold’s trading volume surged 70% in June; EigenLayer unveiled EigenCloud to enhance trust and verifiability for apps; Ethena Labs and Securitize enabled atomic swaps between BUIDL and USDtb.

Quick Take

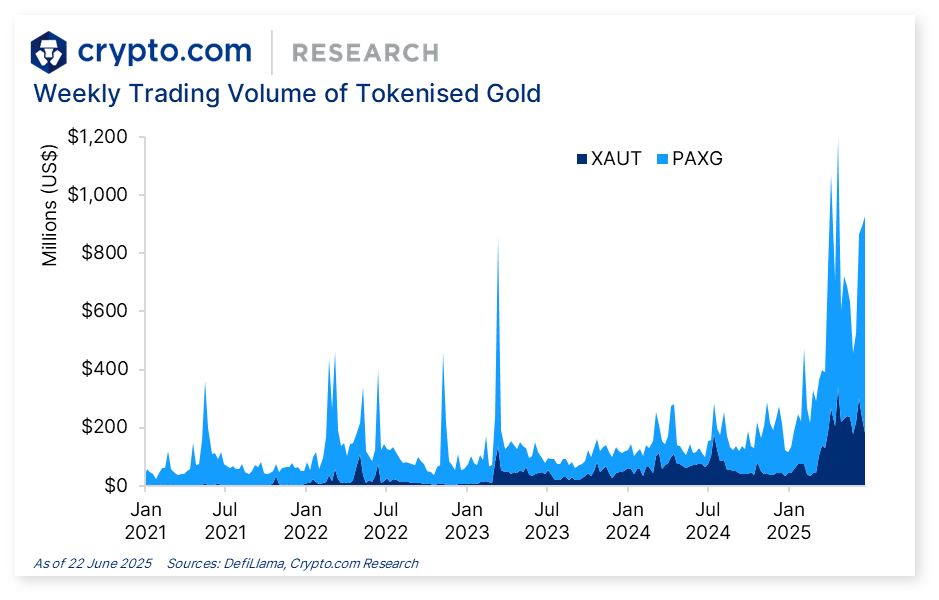

The weekly trading volume of tokenised gold hit record highs with Pax Gold (PAXG) and Tether Gold (XAUt) achieving a combined US$895 million in the last week, which is 70% higher than its volume in the first week of June.

EigenLayer unveiled its new developer platform, EigenCloud, which aims to enhance trust and verifiability for on-chain and off-chain apps.

Ethena Labs and Securitize enabled 24/7 atomic swaps between BlackRock's tokenised fund BUIDL and Ethena's stablecoin USDtb.

Jupiter will pause governance votes until the end of 2025 because of structural issues and a breakdown in trust.

The Norwegian government plans to temporarily restrict new data centers for BTC mining to conserve electricity.

Weekly DeFi Index

This week, the market capitalisation and volatility indices increased by +0.37% and +23.84%, respectively, while the volume index dropped by -4.31%.

Aave (AAVE) is set to expand to Aptos, a non-Ethereum Virtual Machine (EVM) blockchain. This marks Aave’s first non-EVM integration, leveraging Aptos’s high throughput and low transaction fees to enhance Aave’s protocol performance.

Chart of the Week

The weekly trading volume of tokenised gold reached record highs recently. While the crypto market went through recent fluctuations, trading activity around tokenised gold continued to rise. The combined trading volume of XAUt and PAXG reached around $895 million in the last week, which is 70% higher than its volume in the first week of June. The trend started in April when the price of spot gold increased because of economic uncertainty.

News Highlights

EigenLayer introduced EigenCloud, a new developer platform designed to enhance trust and verifiability for on-chain and off-chain applications. EigenCloud uses EigenLayer’s Autonomous Verifiable Services (AVS) and aims to empower Web2 applications with blockchain’s trustless features.

Ethena Labs and Securitize enabled 24/7 atomic swaps between BlackRock’s tokenised fund BUIDL and Ethena’s stablecoin, USDtb. This integration allows institutions and DeFi users to access on-chain dollars.

Jupiter, a Solana-based decentralised exchange (DEX), will pause governance voting until the end of 2025 because of structural issues and a breakdown in trust. The team aims to refocus its governance process to empower the community while enabling the decentralised autonomous organisation (DAO) to be more productive. While staking rewards will continue at 50 million JUP per quarter, no new work groups will be created.

The Norwegian government plans to temporarily restrict new data centers for Bitcoin mining to conserve electricity and address local energy needs. The proposed restrictions are set to take effect in autumn 2025.

Recent Research Reports

Crypto Options: Crypto options are similar to traditional finance (TradFi) options, except the underlying assets are crypto or crypto-related contracts. Compared to the crypto spot and futures markets, crypto options still represent a small but growing market.

Interest Rate Derivatives and Pendle: Pendle Finance allows users to tokenise and trade future yields, unlocking new liquidity and yield management strategies.

Alpha Navigator: Quest for Alpha [May 2025]: The value of most asset classes increased in May with crypto taking the lead. Ethereum’s Pectra upgrade went live on 7 May, and BTC reached an all-time high on 22 May. These coincided with multiple tariffs in the same month.

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT. The latest crypto market insights are also available via the dashboard.

Author

Research and Insights Team

Disclaimer

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

We’re all ears.

Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you!

Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!

Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work.