Market Pulse by the Crypto.com Research & Insights Team (Week 33, 15/08/2022 – 22/08/2022)

ETH options skew rises as traders bid up puts with The Merge closing in. ETH perpetual futures funding rates printing negative. BTC technicals look shaky as crosses key moving average to the downside.

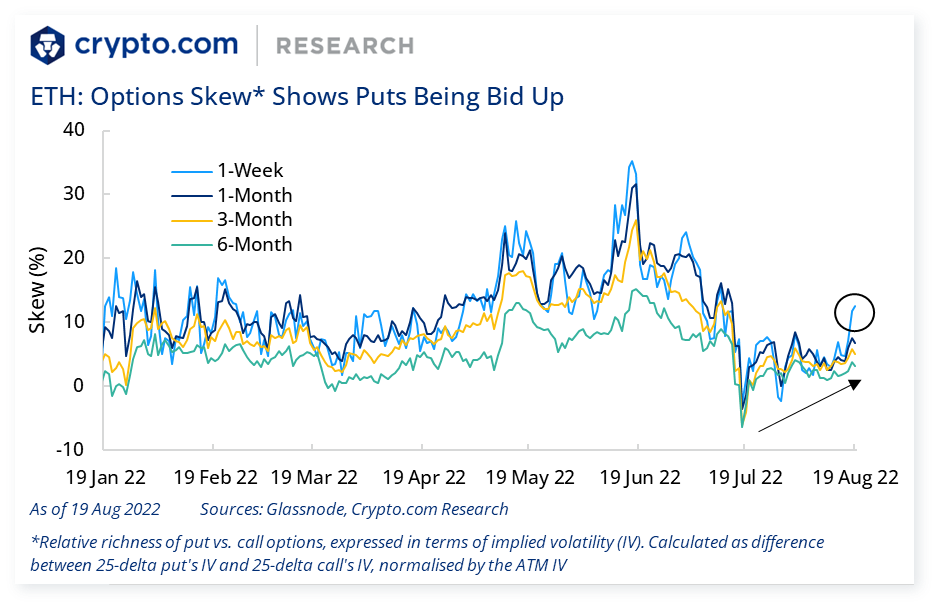

Chart of the Week: Shopping for ETH Puts

ETH options put skews (puts minus calls) dropped precipitously back in mid-July 2022, when Ethereum developers announced a soft target date of September for The Merge, as traders placed their bets on a price surge by dumping puts for calls.

However, since then, put skews have been quietly crawling back up, and the 1-week skew has currently spiked up to the highest level since mid-July. Puts are being bid up - ETH did skyrocket by 78% (as of 21 August) since The Merge target date was announced in July, and the increased bidding intensity for puts is perhaps a sign of traders looking to manage risk of an ETH reversal.

Fund Flow Tracker

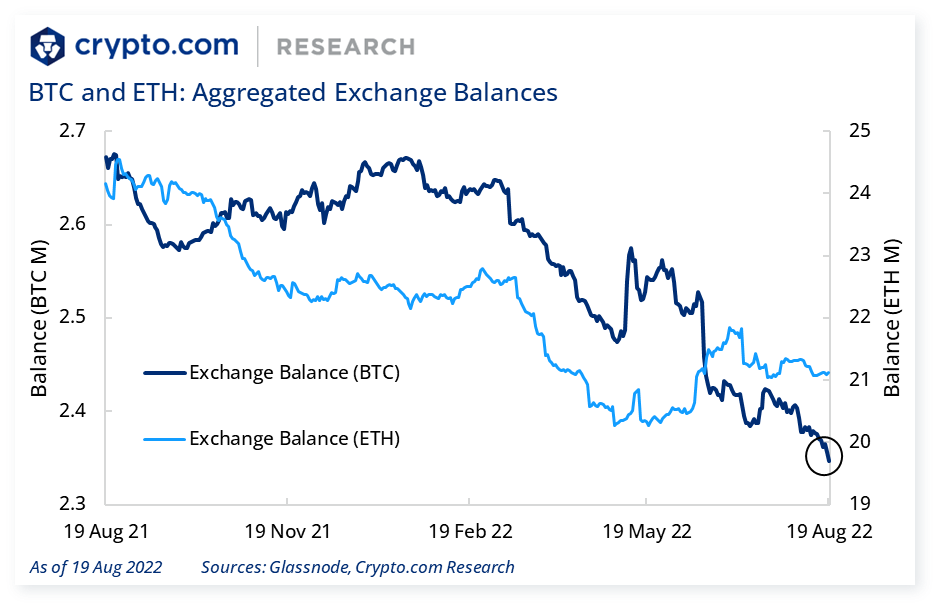

Aggregated exchange balance of BTC has dipped sharply over the past 3 weeks, reaching a new yearly low, while ETH’s has been relatively stable.

Derivatives Pulse

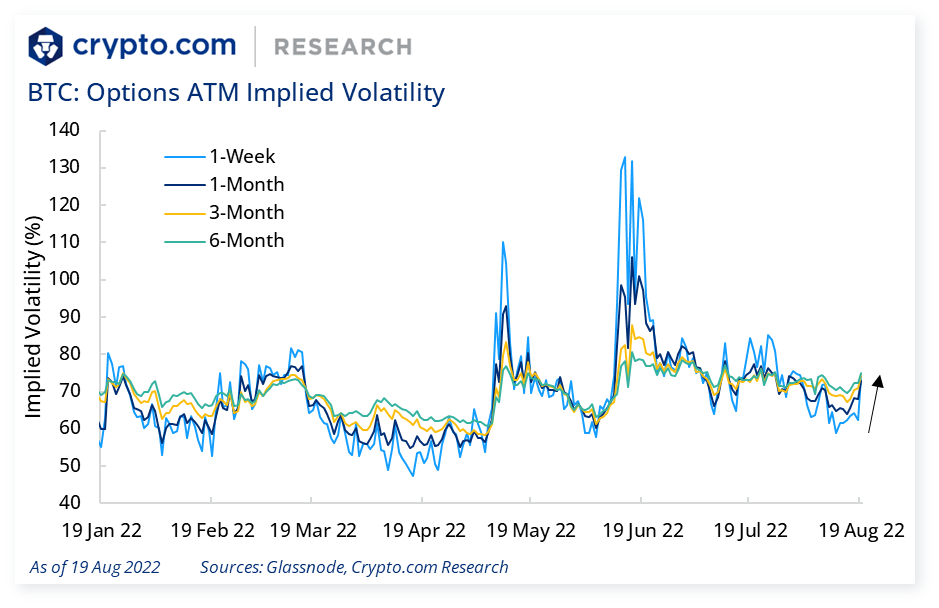

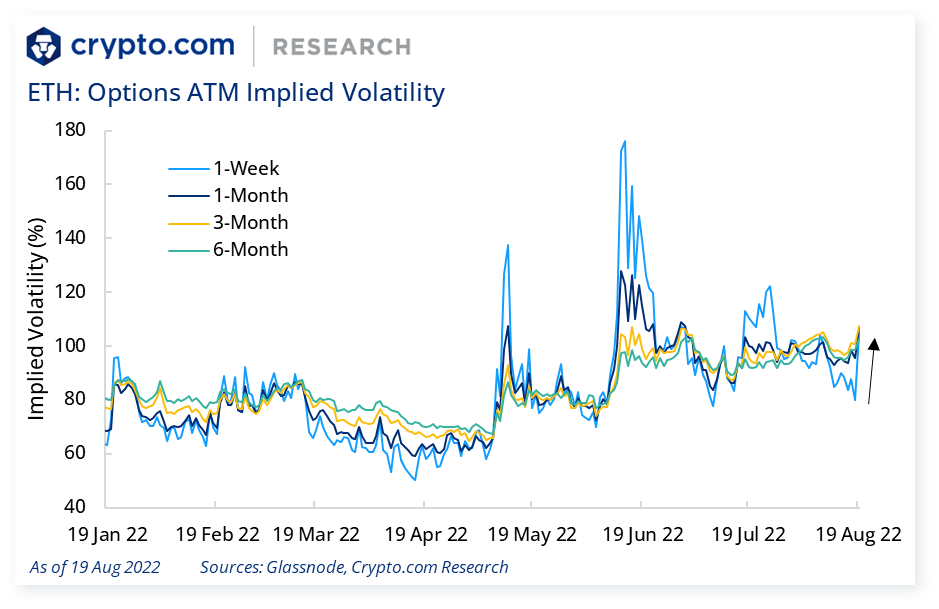

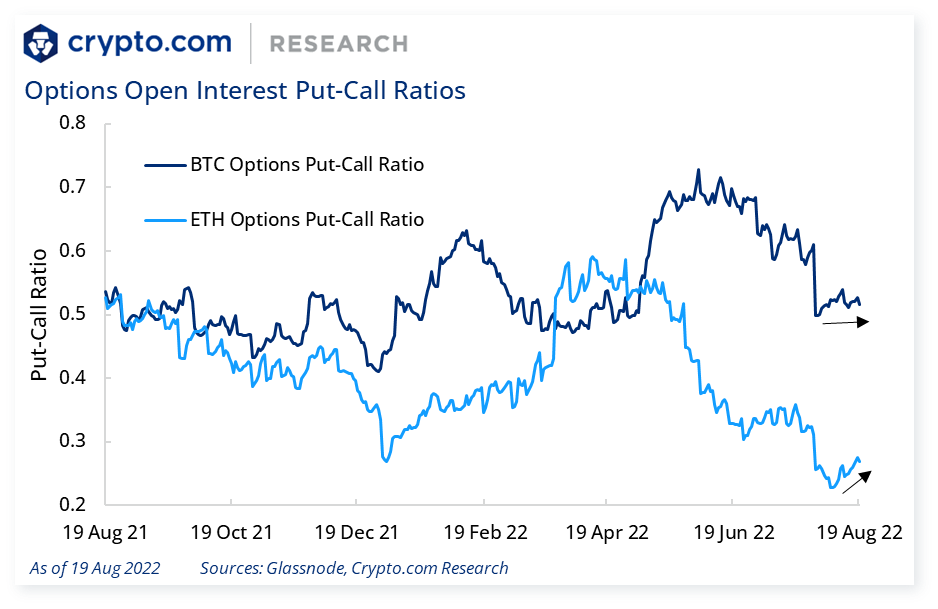

Implied vols and skews (puts minus calls) spiked during the past week. 1-week implied vol currently stands at 74.1% (vs. 58.7% a week ago) and 104.8% (vs. 84.8% a week ago) for BTC and ETH, respectively. The ETH put-call ratio has also been ticking up recently.

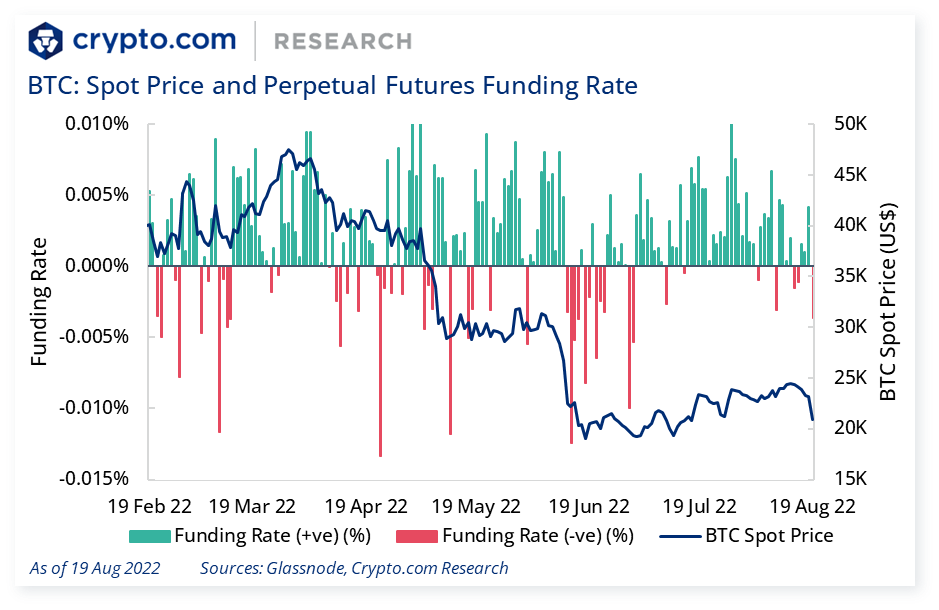

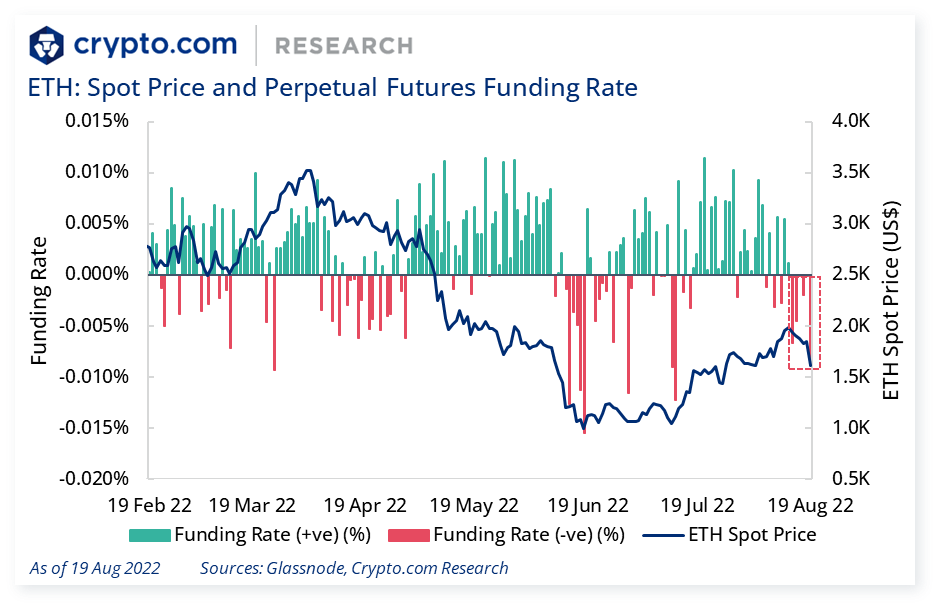

ETH perpetual futures funding rates printed mainly negative over the past week, while BTC’s remained in positive territory.

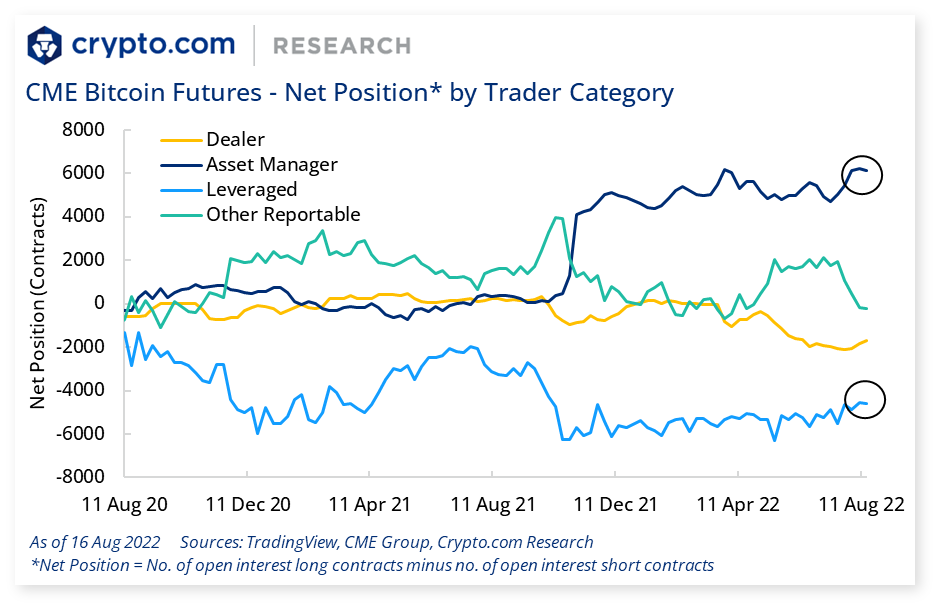

Asset managers’ net-long position in CME Bitcoin futures remains at an elevated level, and leveraged traders’ net-short position is near the lowest level YTD.

Leveraged traders are typically hedge funds and various types of money managers, including commodity trading advisors and commodity pool operators. The traders may be engaged in managing and conducting proprietary futures trading, and trading on behalf of speculative clients.

The asset manager category consists of institutional investors, including pension funds, endowments, insurance companies, mutual funds, and those portfolio/investment managers whose clients are predominantly institutional.

The dealer category consists of participants typically described as the “sell-side” of the market. These include large banks and dealers in securities, swaps, and other derivatives. The other reportable category consists of traders mostly using markets to hedge business risk, and includes amongst others corporate treasuries.

Technically Speaking

The positive technical picture that has been in place for the past one month is starting to look shaky, with BTC recently crossing the 10-day and 50-day moving averages on the way down.

Price Movements

As of 21 Aug 2022 Source: CoinGecko.com, Crypto.com Research

Source: Crypto.com

News Highlights

Crypto.com receives registration approval as a cryptoasset business from the UK Financial Conduct Authority (FCA). In other Crypto.com related news, the exchange reduces trading fees by up to 80%.

CME Group, the world’s largest financial derivatives exchange, announced its plans to launch options on Ether futures on 12 September, pending regulatory approval.

Canada’s second-largest pension fund, CDPQ, has written off its US$150M investment in crypto lender Celsius.

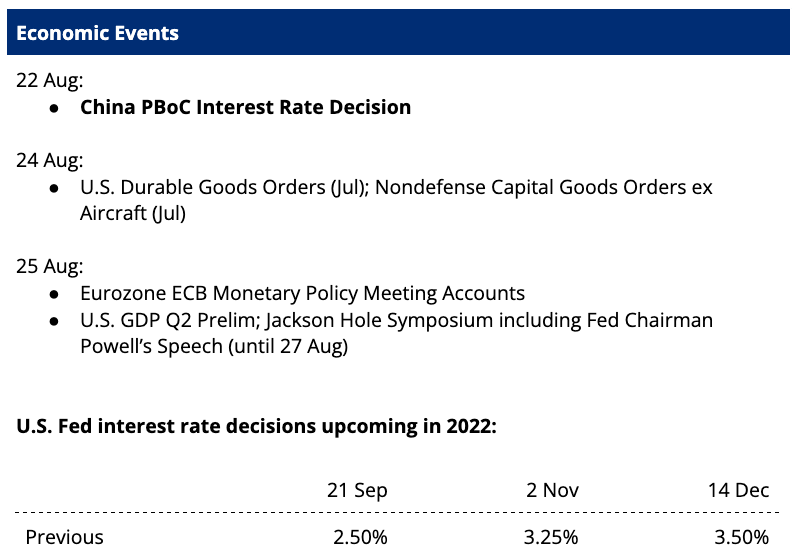

A recent poll from Reuters has most economists predicting a 50 bps interest rate hike from the U.S. Fed at its next meeting on 21 September.

Samsung has been identified as the most active investor in blockchain companies since September 2021.

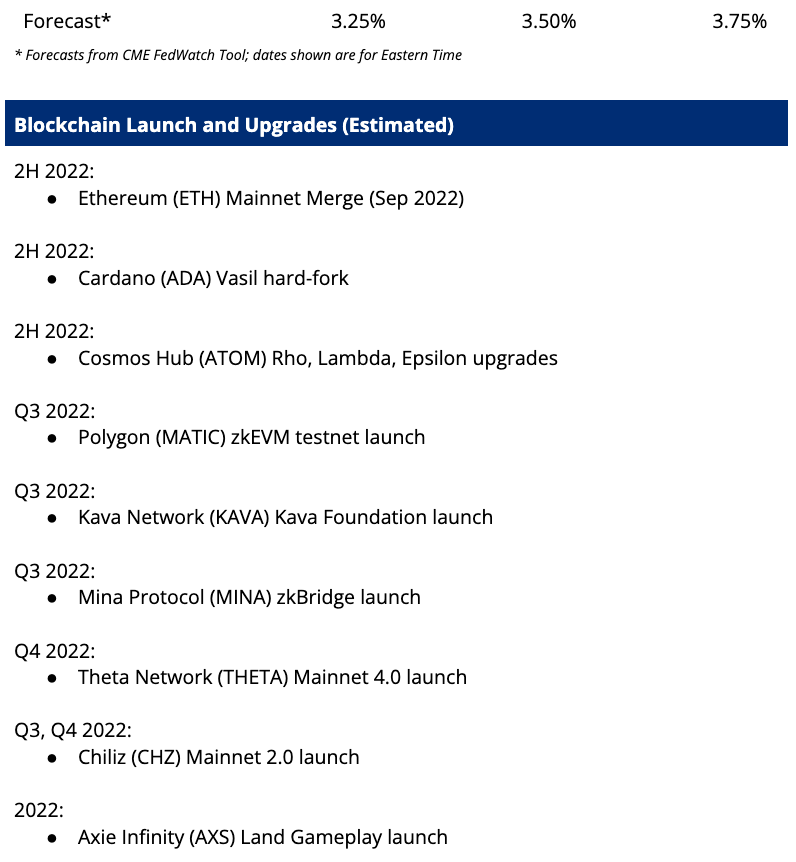

Catalyst Calendar

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!