Market Pulse by the Crypto.com Research & Insights Team (Week 5, 24/01/2023 – 30/01/2023)

Crypto.com achieves ISO 27017 & 27018 security & privacy certifications. $BTC mining network hits new record for difficulty & hash rate. Shadow fork testing begins for $ETH's Shanghai upgrade.

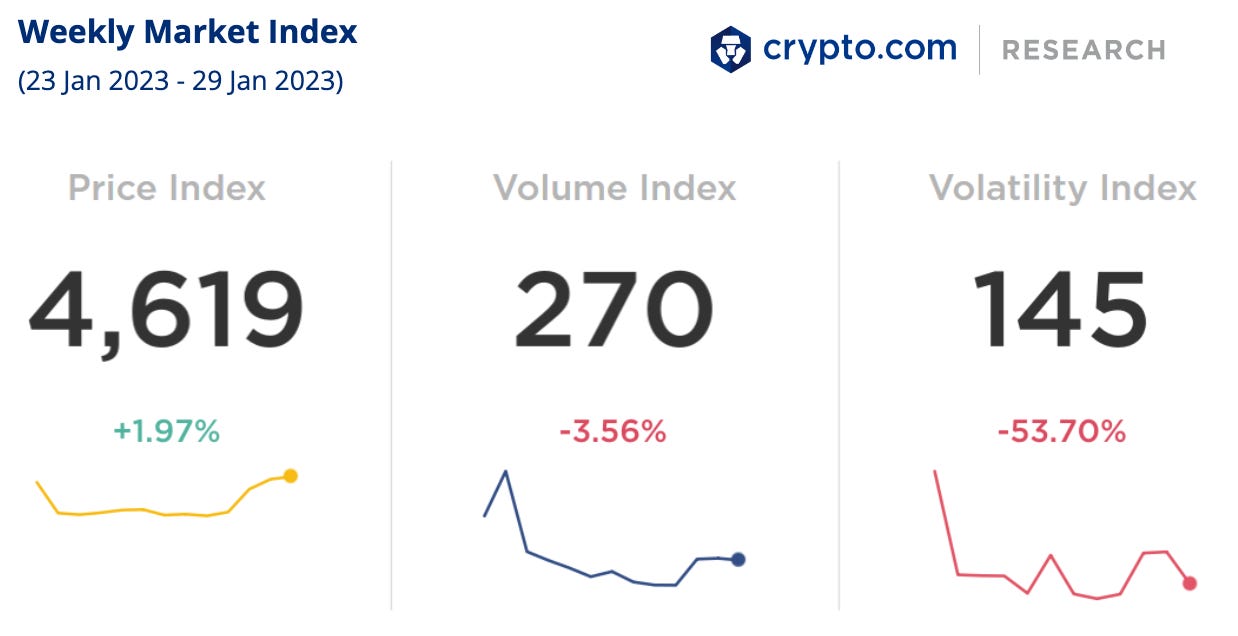

Weekly Market Index

Last week’s crypto market prices rose slightly by +1.97%. Volume and volatility decreased by -3.56% and -53.70%, respectively.

Sources: Crypto.com Research, Crypto.com Price

Notes: Based on market-cap adjusted index of selected top-cap tokens

Weekly Performance

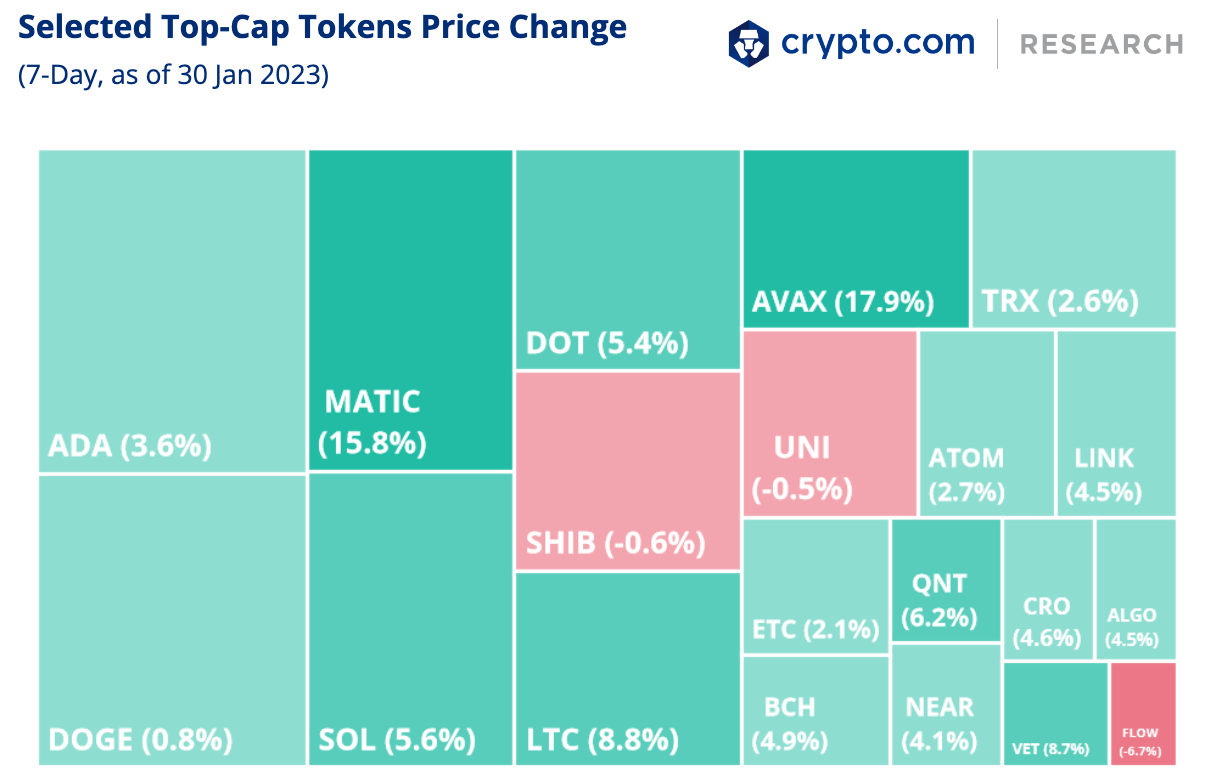

Bitcoin (BTC) and Ethereum (ETH) were up +3.9% and +0.3% in the past seven days, respectively.Avalanche (AVAX) and Polygon (MATIC) were the top performers among selected top-cap tokens. Polygon’s zkEVM launch is drawing near, tweeted by Sandeep Nailwal, co-founder of Polygon, while Avalanche recently collaborated with Amazon Web Services to support developers to launch and manage nodes on the Avalanche blockchain.

Sources: Crypto.com Research, CoinGecko

Notes: Selected top-cap tokens; rectangle size represents market cap

News Highlights

Crypto.com announced it has been certified with ISO 27017 for security in the cloud and ISO 27018 for privacy protection in the cloud as audited by SGS, an internationally-recognized certification authority. These two certifications are both firsts for a digital asset platform.

The first set of testing has commenced for Ethereum’s much anticipated Shanghai upgrade. Developers said they successfully created a copy of the blockchain – known as a “shadow fork” – to provide a testing environment.

The Bitcoin mining network hit new records for mining difficulty and hash rate despite market headwinds. Taken together, both hash rate and mining difficulty are typically seen as indicative of a strong and growing network. Additionally, America’s first nuclear-powered Bitcoin mining center is scheduled to open in Pennsylvania in Q1 2023.

Moody’s, a credit ratings agency, is reportedly working on a system to score up to 20 stablecoins based on the quality of their reserves attestations.

The Ministry of Justice in South Korea announced plans to introduce a crypto-tracking system to monitor transaction history, extract information related to transactions and check the source of funds before and after remittance.

Recent Research Reports

Crypto Market Sizing Report: Global crypto owners reached 425 million by the end of 2022. Bitcoin and Ethereum owners grew by 20% and 263%, respectively.

2022 Year Review & 2023 Year Ahead: 2022 has been a ride for the crypto industry. In this report, we curate the top ten crypto events and trends of 2022, followed by our outlook for 2023.

Alpha Navigator (December 2022): The new year sees crypto outperforming equities and gold. BTC options implied volatilities are subdued while perpetual futures funding rates are positive.

Catalyst Calendar

* Forecasts from CME FedWatch Tool; dates shown are for Eastern Time

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are registered trademarks of their respective owners.

Thank you for reading! We hope you find Market Pulse, our new weekly market insights newsletter enlightening!

Hungry for more? Visit our Research Hub and University to access other insightful crypto research!

Share with a friend if you like our email!